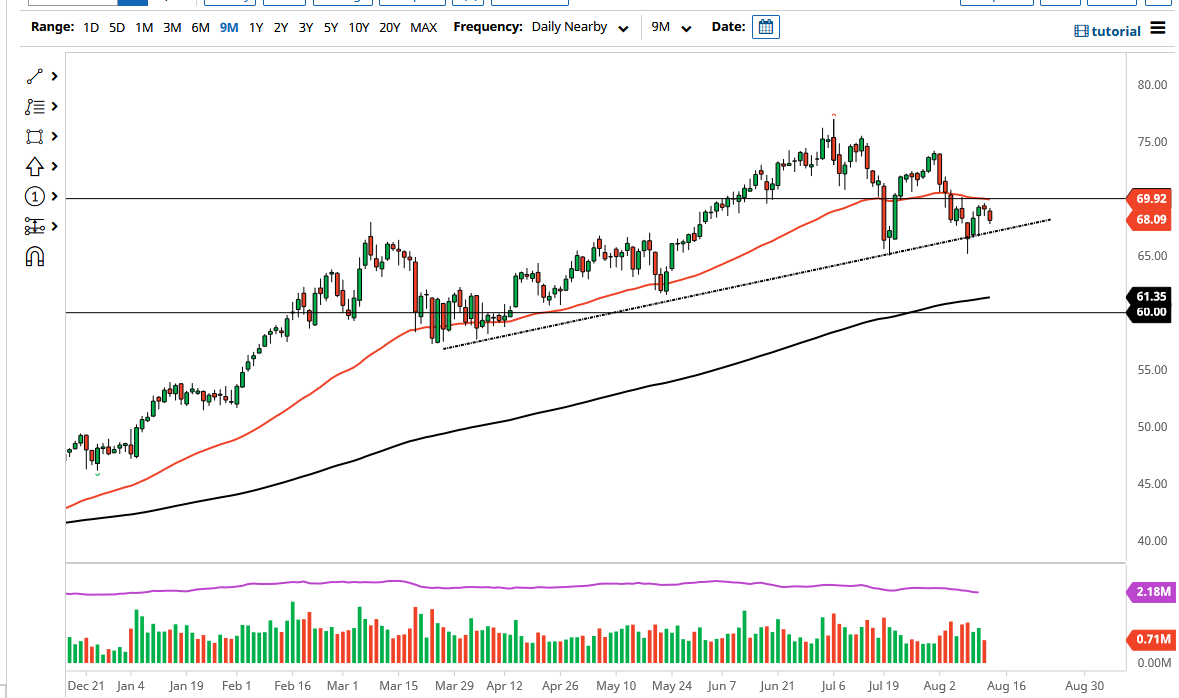

The West Texas Intermediate Crude Oil market pulled back a bit during the trading session on Friday as we have reached towards the $60 level. We have an uptrend line underneath that traders will be paying close attention to, and I think it is likely that we will see a certain amount of support attached to it. Furthermore, we also have the previous “double bottom” sitting at the $65 level, so I think the market will certainly respect that. Breaking down below it would obviously be a major turn of events that could send this market reeling.

The crude oil market is dealing with the idea of the Delta variant slowing down demand and shutting down borders. While we have not seen major lockdowns yet, it is worth noting that there have been a couple of ports in China that slowed down and closed, just as there have been three major cities in Australia that saw the same thing happen. That being said, it is not enough to cause panic in the market, but we should definitely keep an eye on the story as it could cause a lot of headaches. On the other hand, if we see the US dollar sell off, then it may possibly allow the oil markets to rally, and if we see further reassurance that the virus will not shut down the global economy, then it is possible that oil will rally.

From a technical analysis perspective, the uptrend line should be supportive, but the 50-day EMA just above should be resistance. Furthermore, we have the $70 level sitting at the same region, so I think a breakout above all of that would obviously be a very bullish sign. At that point, the market should then go looking towards the $74 level where we had sold from previously. On the other hand, if we break down below that $65 level then it is possible that we would go looking towards the 200-day EMA, currently sitting at the $61.35 handle. Underneath there, then the market is likely to go looking towards the $60 level, which is a large, round, psychologically significant figure and would attract a lot of attention in general. Until we get some type of impulsive candlestick though, you will need to keep your position size relatively small.