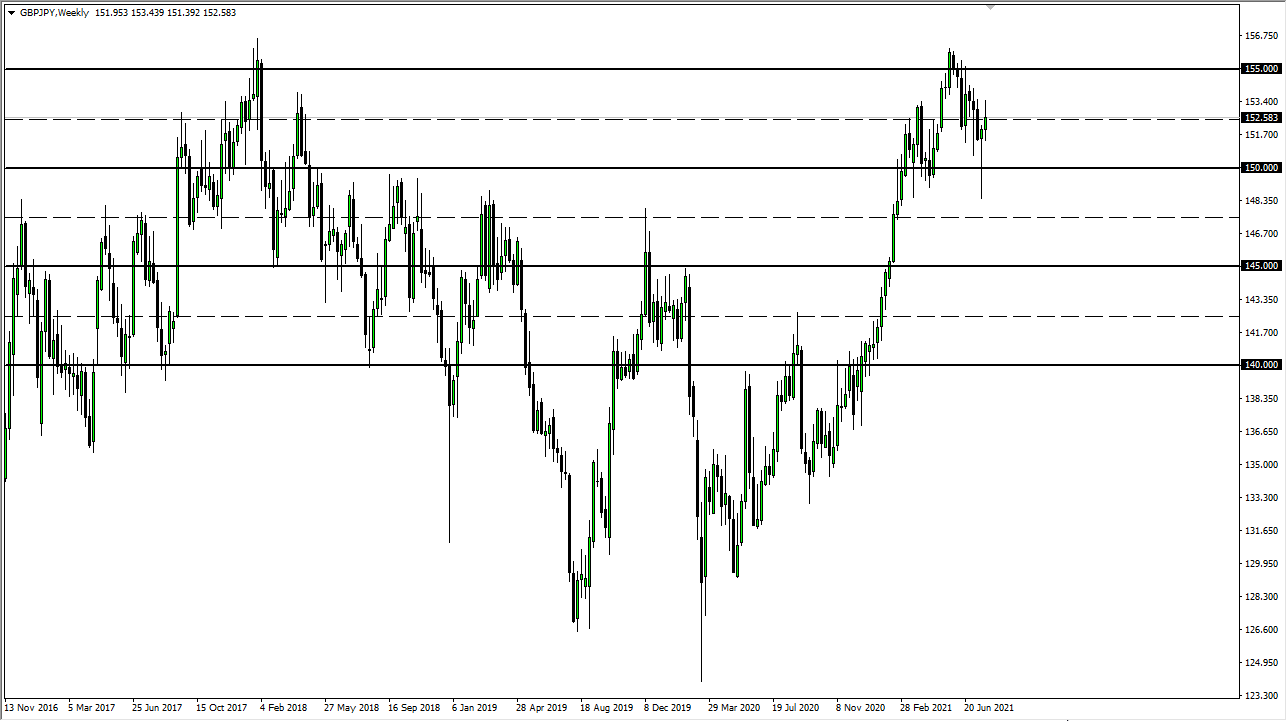

GBP/JPY

The British pound had another good week against the Japanese yen, but as you can see towards the end of it, we did pull back. I think that sets us up for a little bit of a pullback this week, but ultimately, I think there is plenty of support underneath, especially near the ¥150 level. If we give up the ¥150 level, that could spell trouble and send this market much lower. That would obviously be a major “risk off event” type of situation. I fully anticipate that the buyers will be back, but we may have a day or two of rough trading ahead of us.

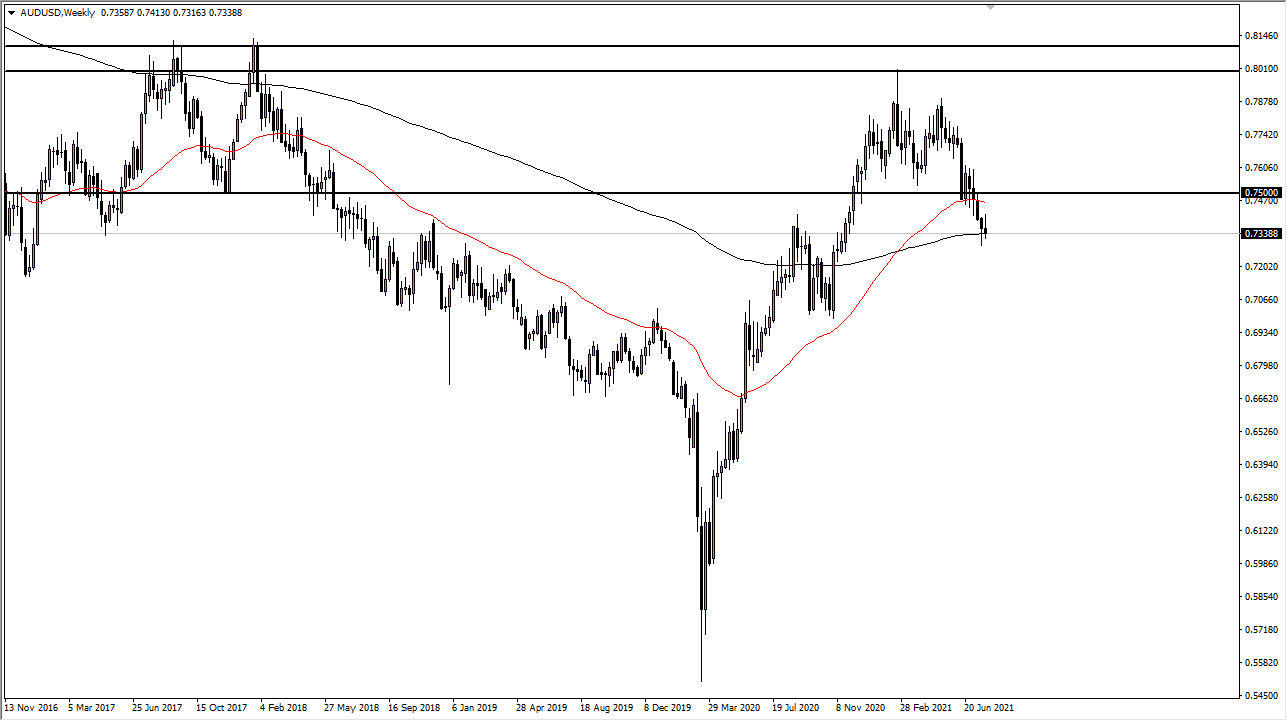

AUD/USD

The Australian dollar initially tried to rally during the week but has given back all of the gains to form a bit of an inverted hammer. That is a very negative sign, and I think if we break down below the last couple of weekly candlesticks, it is likely that we will go looking towards the 0.70 level. Any rally at this point will probably be sold into all the way up to the 0.75 handle. If we were to break above there, then it could change things, but right now it certainly does not look like it is going to happen anytime soon.

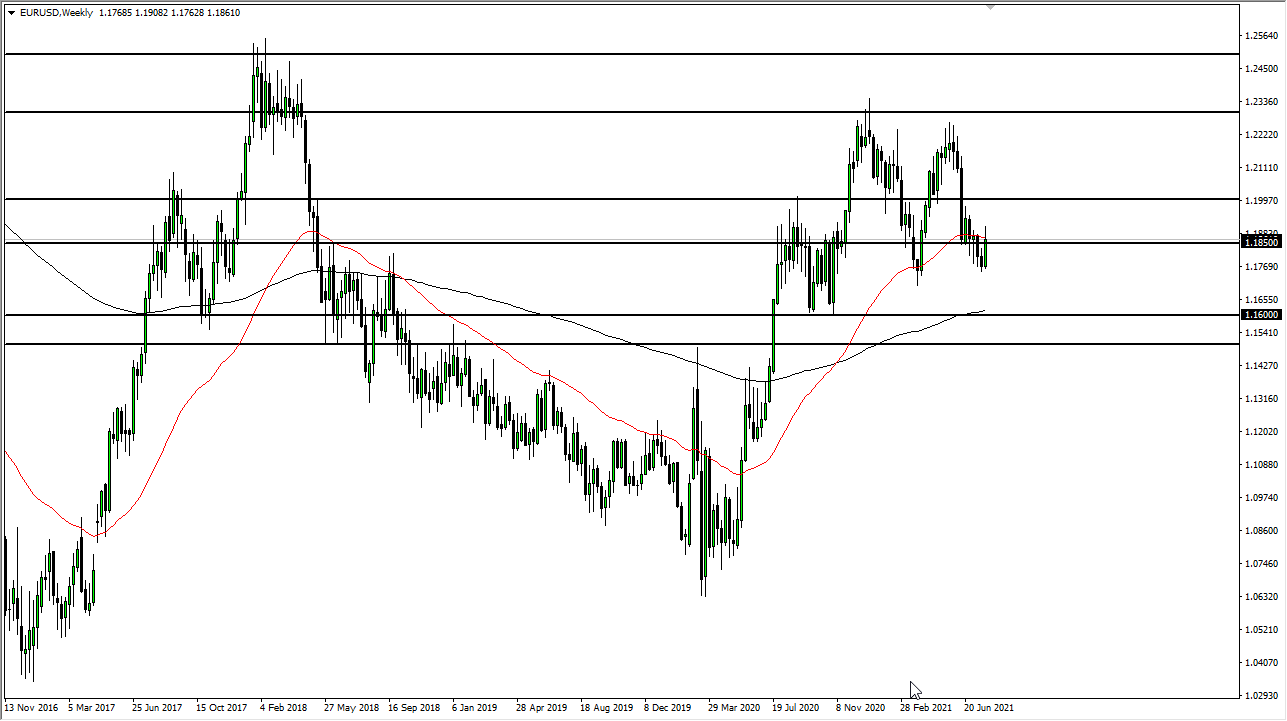

EUR/USD

The euro rallied during the course of last week, breaking above the 1.1850 level. However, we have given back quite a bit of the gains, so it is obvious that the market will continue to struggle, but I think what we will see more than anything else will be sideways action as we try to figure out what is going on with global risk. If we can break above the 1.19 level, then it is possible that we could go towards the 1.20 handle, but right now it looks like we are struggling for directionality more than anything else.

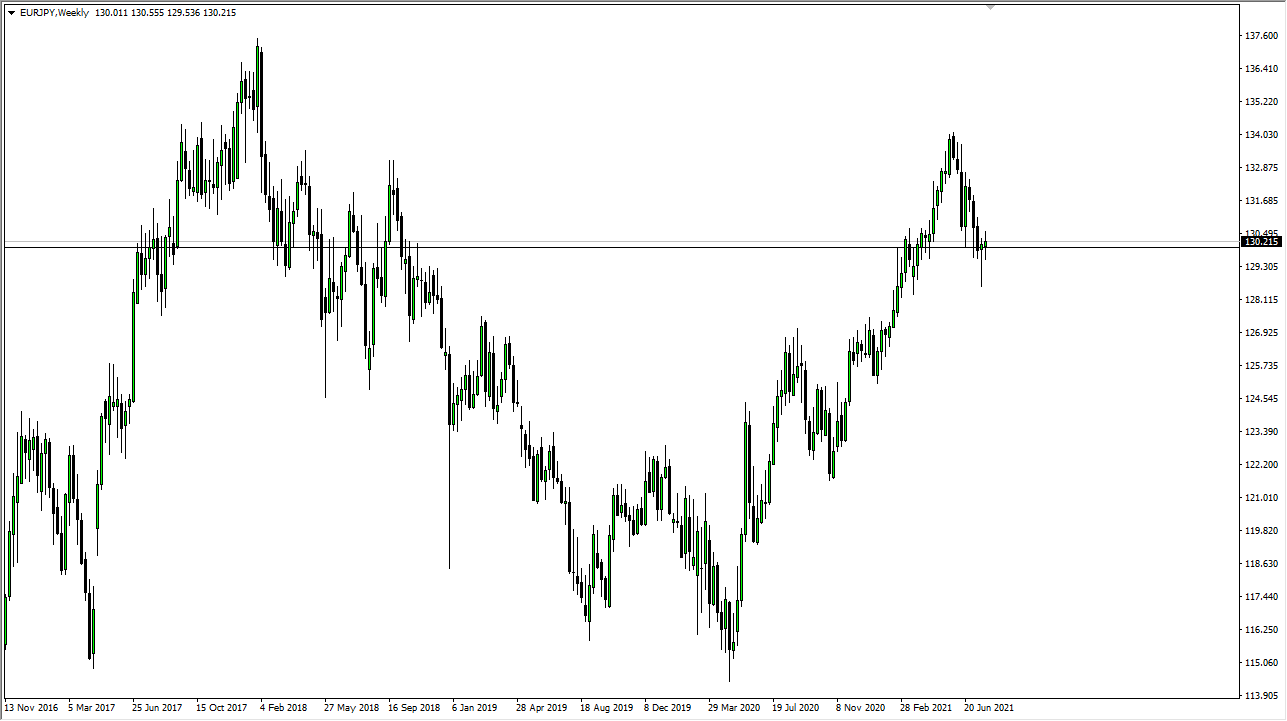

EUR/JPY

The euro has been back and forth against the Japanese yen just as it has been against the US dollar. However, we are sitting right at the ¥130 level, and I think that adds more credence to this pair predicting the risk appetite of the markets in general. If it can break above the highs of this past week, the EUR/JPY pair could very easily go looking towards the ¥132 level. Breaking down below the lows of the candlestick from last week would be catastrophic and send this pair much lower in a major “risk off attitude.”