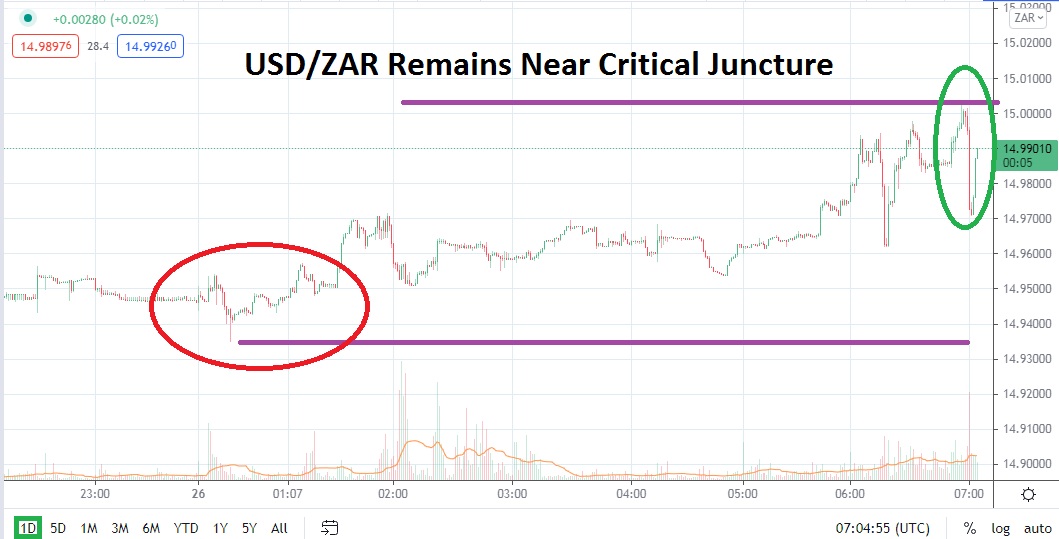

As of this writing, USD/ZAR is near the important 15.00000 ratio, but this has been the case since early this week. The fact that consolidation has now been produced on a fairly consistent basis the past few days of trading should encourage speculators that some of the rather volatile price velocity within USD/ZAR is eroding. If the Forex pair continues to show signs of a stable environment this could certainly attract additional speculative forces which have perhaps been hesitant to trade the USD/ZAR the past month because of its rather large price swings.

Certainly speculators crave volatility, because at the end of the day this is what often produces the results which attract traders to wager within Forex. However, the recent price ratios within the USD/ZAR have been problematic because of the rather turbulent behavioral sentiment generated which caused fast moves. While the bullish move higher the past month was definitely an opportunity to take advantage of nervousness which dominated South Africa news events, it also meant traders needed to be extra diligent.

If the USD/ZAR can maintain its current price level and remain below the 15.0000 ratio it may be a rather intriguing bearish signal. Yes, on the 20th of August the USD/ZAR was trading near important mid-term highs of 15.40000, but the trend lower has been rather consistent, and short term support levels were brushed aside rather easily in the past week.

Trading is seldom a one-way avenue, and thus the recent bearish cycle produced the past handful of days, while welcome by sellers, also needs to remain practical regarding perspectives. The USD/ZAR hit a low of 14.90000 yesterday and did experience a slight reversal higher which it has maintained as of this writing.

Traders who have been encouraged by the recent ability of the USD/ZAR to reassert some bearish momentum may view the consolidation as a normal and healthy market function. If the 15.0000 to 15.05000 marks are not significantly punctured higher short term, it could mean a selling opportunity exists for bearish speculators. Wagering with selling positions of the USD/ZAR on slight reversals higher may prove to be a solid opportunity near term. The current phase of consolidation within the USD/ZAR is unlikely to remain and traders need to have their risk management tools working as they pursue their price targets.

South African Rand Short-Term Outlook:

Current Resistance: 15.05600

Current Support: 14.95700

High Target: 15.14000

Low Target: 15.11000