I tested the resistance level 109.71, which is stable around at the time of writing the analysis. The US dollar cautiously anticipating the US job numbers and the principle of safety and preserving the gains, note to closing the buy recommendation until we identify the reaction from the important expected data.

Dollar traders are likely to continue holding out ahead of tomorrow's US Non-Farm Payrolls report, as major indicators are giving mixed signals. The ADP Nonfarm Employment Change figure turned out to be a big disappointment, suggesting that the official government figures may be disappointing as well. Also, the ISM Manufacturing PMI came in weaker than expected while the Services PMI exceeded expectations, although both surveys showed employment growth for July. The report on the number of jobless claims will also give an impression today.

Analysts expect to see a gain of 895,000 in US employment for the month, slightly stronger than the previous increase of 850,000. The downside surprise may confirm that the US Federal Reserve's stimulus led by Jerome Powell will stay in place for a longer period, likely to boost risk appetite, while the upside surprise in the numbers may revive the Fed's tightening talks.

In contrast, Japan is now in a fourth state of emergency. Tokyo has been in that state for most of this year. Tokyo has recorded a record number of daily cases, totaling several thousand, as it has tripled since the Olympics opened on July 23. Experts say the number could reach 10,000 people within two weeks. Meanwhile, Japan is among the slowest vaccine launches in the developed world, with about a third of the adult population fully vaccinated. Although the elderly are given priority, people have complained that registering for doses, over the phone or online, has been frustrating, and waiting for the numbers to change after the Olympics event.

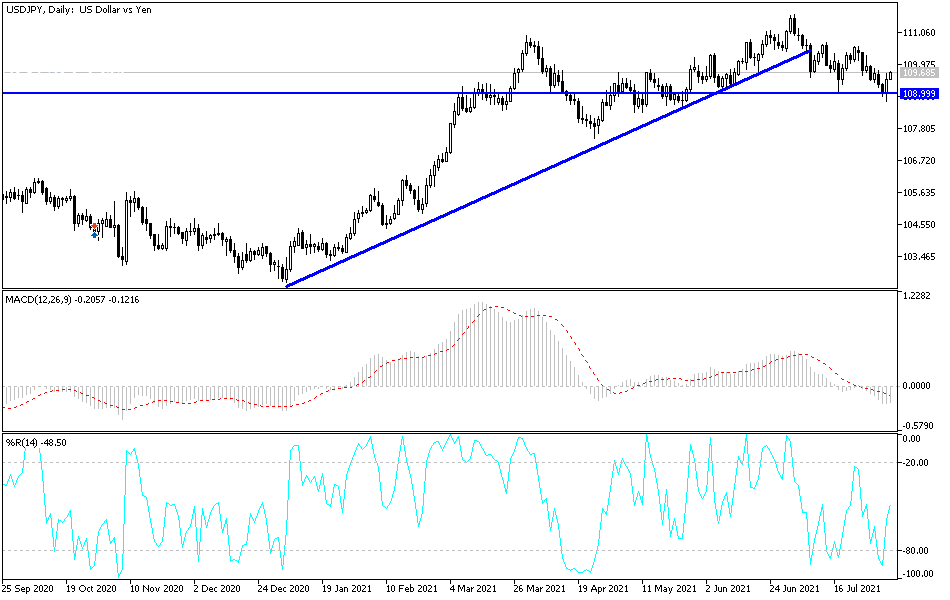

According to the technical analysis of the pair: USD/JPY is forming lower tops connected to a new descending trend line on the 4-hour chart. The price has recently bounced off the lows at 108.73 and is retreating to the descending resistance area. With the application of the Fibonacci retracement tool on the latest swing high and low it also reveals that the levels of 50% to 61.8% are aligned with this trend line, adding to its strength as resistance. 61.8% Fibonacci is near the 110.00 resistance and lines up with the dynamic 100 SMA resistance as well.

The 100 SMA is below the 200 SMA to confirm that the general trend is still bearish, and that the resistance is more likely to hold than to break. If this is the case, the USDJPY could reconsider the dips or head lower than here. The stochastic is pointing up to indicate that the correction is still in progress, but the oscillator is approaching an overbought area to indicate exhaustion. A shift down will confirm that the sellers will take off again. The closest current targets are 109.25, 108.80 and 108.00, respectively.