The bulls have pushed the USD/JPY above the 110.35 resistance, where the pair is stabilizing as of this writing. The US dollar is still supported against the rest of the other major currencies, amid strong expectations for the future of monetary policy tightening by the US Federal Reserve, especially after the impressive numbers from the US labor market. Commenting on the performance of the US dollar, Zach Bundle, currency analyst at Goldman Sachs, said: “Federal Deputy Governor Waller told CNBC on Monday that the quantitative easing timeline should be fast enough 'to make sure we are in a position to raise interest rates in 2022 if we have to.'"

While neither represent the full committee's view (Vice President Clarida's term ends in January 2022), markets may need to price an "early rise" risk premium.

The analyst added, “We do not see a case for a sustained dollar rally: the global economy will benefit from a fortification tailwind over the coming quarters, the US economy should slow as the fiscal impulse turns negative, and lower inflation should allow the Federal Reserve to remain on hold for an extended period.”

Bundle and the Goldman Sachs team cite the worsening coronavirus situation in Asia, recent US data surprises, and more tangible risks of changes to Fed policy that could come earlier than they expected. The Fed has so far been guided by the belief that the dollar could remain high short term.

Among the good news for the US economy, US employers posted a record 10.1 million job vacancies in June, another sign that the labor market and economy are recovering strongly from last year's coronavirus shutdowns. Yesterday, the US Department of Labor reported that job openings rose from 9.5 million in May. Employers employed 6.7 million workers in June, up from 6 million in May. The gap between employment vacancies and employment means that companies are striving to find workers. Ongoing health concerns, difficulty obtaining child care at a time when many schools are closed and the extension of federal aid to the unemployed may have prevented some unemployed Americans from seeking work.

The US Labor Department reported on Friday that the US economy created 943,000 jobs last month and the unemployment rate fell to 5.4% from 5.9% in June.

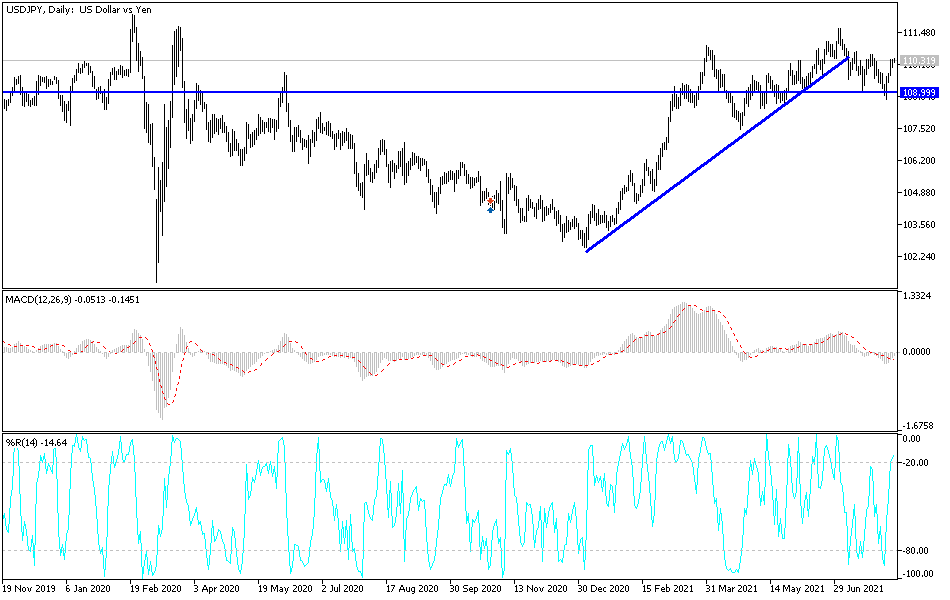

Technical analysis of the pair

The stability of the USD/JPY above the 110.00 psychological resistance will continue to support the bulls’ control over the performance. The most important resistance level for the bulls will remain 111.20, the next target to confirm a long-term bullish trend. Technical indicators still have the opportunity to move higher before reaching strong overbought levels. On the other hand, the trend will turn to the downside again if the currency pair returns to the support levels at 109.45 and 108.80.

The currency pair will be affected by investor risk appetite in light of rising infections, which in turn may lead to the return of restrictions, which threaten the expectations of the global economic recovery.