The US dollar fell against most of the other major currencies at the end of last week, after economic data showed a decline in US consumer confidence in August. Also, investors continued to wait for more clues about the Fed's plan to stop stimulus after producer inflation rose and jobless claims fell for the third week in a row. Many Fed officials have preferred to scale back the quantitative easing program in the coming months given the improvement in the labor market and price pressures. The USD/JPY fell significantly to the support level of 109.55 after gains in the same week pushed it to the resistance level of 110.80, its highest in more than a month.

A preliminary report from the University of Michigan released on Friday said US consumer confidence fell to 70.2 in August from 81.2 in the previous month and well below market expectations of 81.2. It was the lowest reading since December 2011. On the other hand, data from the Labor Department showed that US import prices rose by 0.3 percent in July after rising by a revised 1.1 percent in June. Economists had expected import prices to rise 0.6 percent in July compared to the 1 percent jump originally reported from the previous month.

Meanwhile, the Labor Department said export prices rose 1.3 percent in July after a 1.2 percent jump the previous month. Export prices were expected to rise by 0.8 percent.

The stress of the global supply chain is by no means over, and if anything, it could be about to get worse as the delta variant enters China. For currencies, this could just mean more strength in the dollar according to a number of investment bank analysts. The news from China is that the two largest container ports in Shanghai and Ningbo Zhoushan are facing severe bottlenecks, which should serve as a warning to investors that the epidemic has not yet completed disrupting the global supply chain.

The Meidong Container Terminal in Ningbo has been closed due to COVID revelations, and the port handles containers for the China-Europe and China-Middle East route as well as OCEAN Alliance lines. Evidence that supply-side pressures are once again accumulating suggests that the streak of high inflation readings in the US - and indeed globally - could continue for longer than initially expected as the supply-demand mismatch continues.

If supply-driven inflation continues for longer than expected, it is likely that assets that have risen in value in recent months as part of the “inflation hot trade” will find continued support; the dollar is the leading candidate for the G10 FX space. Holger Schmieding, chief economist at Berenberg Bank, says: “Producers continue to suffer from severe supply chain problems caused by shortages of goods and key inputs (such as semiconductors) as well as labour, while disruptions and delays at ports appear to have worsened in recent weeks.” The supply shortage could take until early 2022 to be fully resolved due to complex production structures, according to Berenberg.

Inflation in the US is currently burning (well above the Fed's 2.0% target) on the back of a host of global supply issues and a strong economic recovery. Recently released data indicate that inflationary pressures have become wider, that is, they have begun to appear in a wider range of goods and services in the inflation basket. Commenting on this, Nordea's Saroy says, “We expected the core CPI to remain close to or perhaps above 4% y/y until the second quarter of 2022. When it then starts declining around 2%, the labor market will be tight and wages will increase, Which means that the Fed's average long-term inflation expectations should remain above 2%."

Rising inflationary expectations - which have been widely a dominant theme for the markets in 2021 - are determining the winners in the Forex market.

From this standpoint, the dollar stands out, and is likely to be one of the best performers going forward if the topic of higher inflation for a longer period continues to emerge in the US, forcing the Federal Reserve to bring forward the timing of the first rate hike.

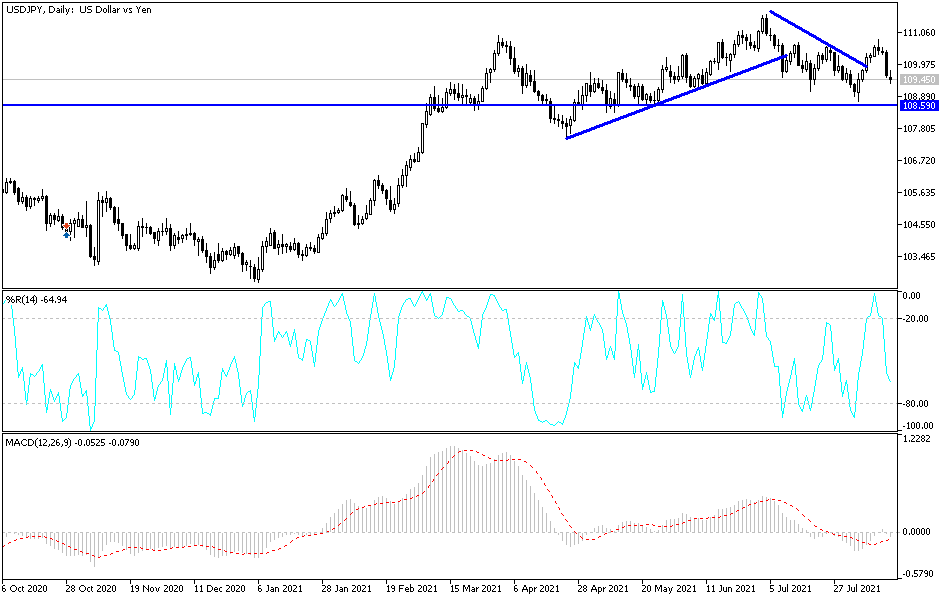

Technical analysis of the pair

The negative results of the Chinese economic data supported demand for the Japanese yen as a safe haven. Therefore, the USD/JPY pair completed the downward path to the support level of 109.32 as of this writing, with th next psychological support being 108.80, which restores the bears’ control over the general trend. I still prefer buying the currency pair from every bearish level. The bulls will return to control the trend if the currency pair moves towards the psychological resistance level of 110.00 again. Otherwise, the bears will remain the strongest.