Expectations of an increase in US interest rates helped boost the US dollar against the rest of the other major currencies. As a result, the USD/JPY currency pair moved to the resistance level of 110.75 as of this writing, its highest in a month. After the impressive US jobs numbers gained momentum in the Forex market, the hawkish comments from Federal Reserve officials intensified hopes that the US central bank will begin to scale back its bond-buying program in the coming months.

Atlanta Fed Governor Rafael Bostic said the Fed may start tapering between October and December, or even sooner provided there is another month or two of strong employment gains. There has been significant progress toward the Fed's target, Bostic said, adding that the July jobs numbers were "certainly very encouraging in that regard."

Bostick and Richmond Fed President Tom Barkin said US inflation has already reached the Fed's 2 percent threshold, one of two conditions required before an interest rate hike.

Investors are awaiting US inflation data due on Wednesday for more clues on the Fed's policy outlook. The US Senate is expected to pass the bipartisan trillion-dollar infrastructure bill and send it to the House of Representatives for a vote. In this regard, Senate Majority Leader Chuck Schumer said that after the vote on the infrastructure bill, the Senate will begin a new debate on a $3.5 trillion plan aimed at expanding social programs.

Preliminary data from the Department of Labor showed that labor productivity in the United States increased much less than expected in the second quarter. The department said that labor productivity jumped by 2.3 percent in the second quarter, after rising by a downwardly revised 4.3 percent in the first quarter. Economists had expected productivity to rise 3.5 percent compared to the 5.4 percent increase reported in the previous quarter. The smaller-than-expected increase in productivity, a measure of hourly production, came with a 7.9 percent jump in production partially offset by a 5.5 percent jump in hours worked. Commenting on the figures, Lydia Bosor, chief US economist at Oxford Economics, said: "We expect limited productivity scars from the pandemic, and we expect that a combination of cyclical and structural factors will promote above-trend productivity growth in the post-Covid era. These factors include a strong investment cycle, increased business dynamism, faster technology adoption, and permanent remote work."

The report also showed that unit labor costs rose 1.0 percent in the second quarter, slightly below economists' estimates of a 1.1 percent increase. Meanwhile, the 1.7 percent rise in labor costs previously reported for the first quarter was revised to a 2.8 percent decline.

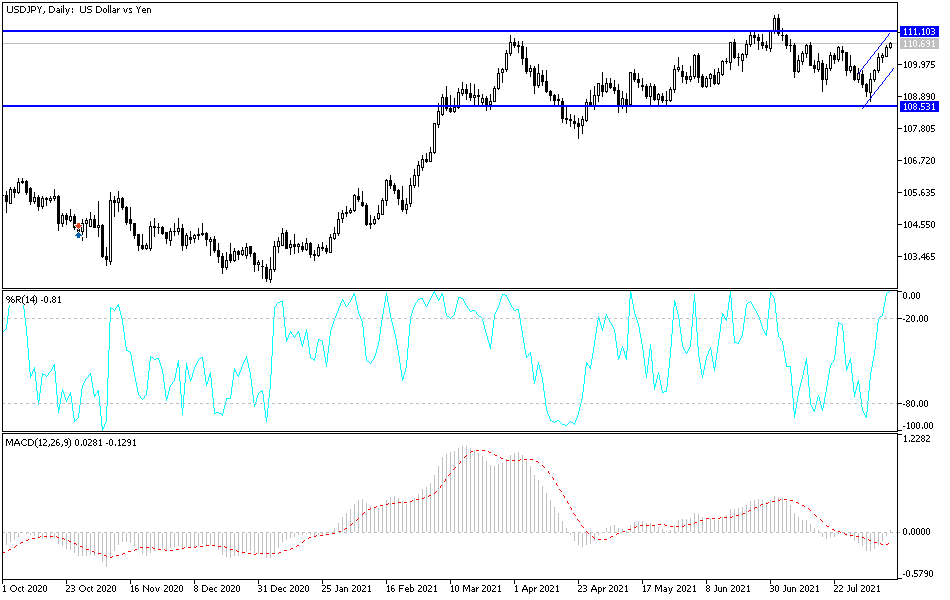

Technical analysis of the pair

On the daily chart, the USD/JPY pair is moving steadily within the range of its ascending channel. As long as it is above the psychological resistance of 110.00, and the technical indicators don't reach overbought levels, the bulls are heading towards the next psychological resistance 111.20. Today's US inflation figures may provide an incentive for the dollar if they exceed expectations, and the US dollar's current gains may be halted if it comes in lower.

The bears will not control the performance again without moving towards the support levels of 109.75 and 108.80. Otherwise, the general trend of the pair will remain bullish. The pair may also be affected by the extent to which investors take risks or not, amid fears of the spread of COVID and global restrictions.