The US dollar has been drifting a bit lower over the last couple of days, as we are starting to see traders around the world get ahead of the Jackson Hole Symposium, and the statement the Jerome Powell will almost certainly put out. If that is going to be the case, then the market is perhaps getting ready to get a huge move. At this point, the market is likely to see the overall consolidation area continue to be important, as we have seen over the last couple weeks.

Keep in mind that the Reserve Bank of India is very “hands-on” when it comes to the rupee, and I think it is likely that we will continue to see comments from the RBI driving the market. At this point, we are trying to measure whether or not the Federal Reserve is in fact going to taper, or if they are just paying lip service to the market in the form of several Federal Reserve governors floating “trial balloons.” It is noted that the Federal Reserve members have recently suggested that there could be tapering by the end of the year, but whether or not that is true might become quite a bit clearer over the next couple of days.

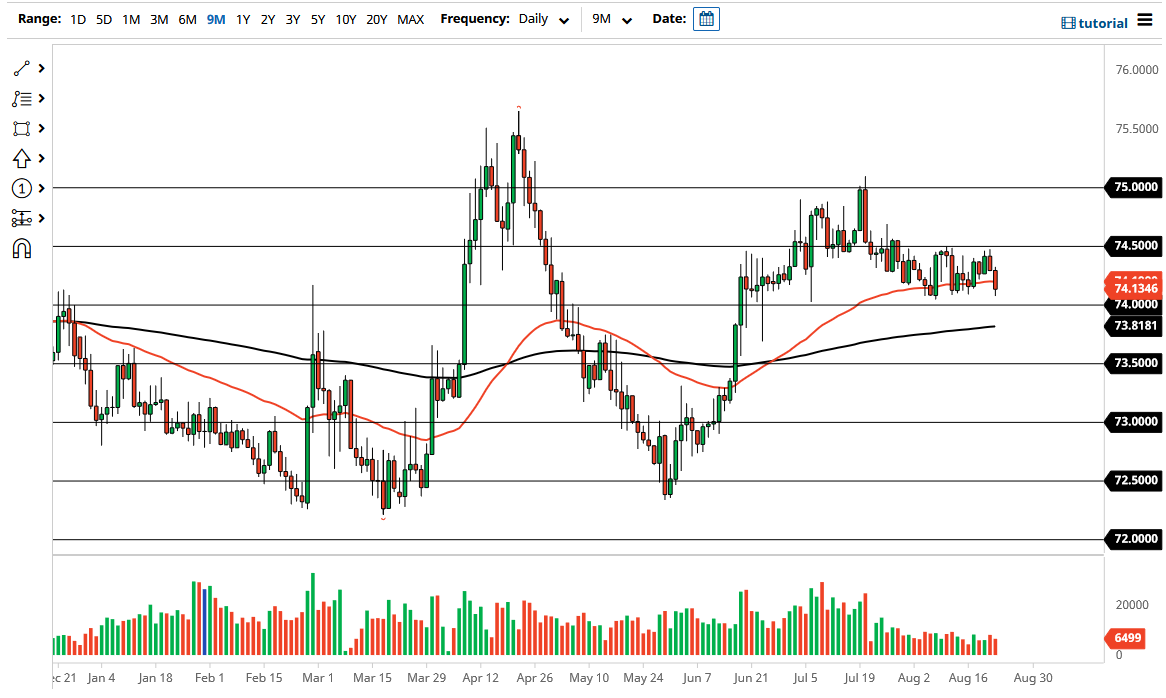

urrently, the USD/INR pair has been trading between the ₹74 level on the bottom and the ₹74.50 level on the top. At this point, the market is likely to continue to see a lot of choppy behavior between now and the statement from Jackson Hole, but it does look as if we are getting a bit “toppy.” However, if Jerome Powell does suggest that there is going to be tapering, then that will more than likely crush emerging market currencies such as the Indian rupee, and the market could go looking towards the ₹75 level at the very highs.

Ultimately, this is a market that I think will continue to see a lot of choppy behavior, and because of that you have to be somewhat cautious with your position size because we could see a sudden burst. India has recovered quite a bit from the coronavirus figures, so that has been helping the situation as of late, but if we start to worry about higher interest rates and a slowdown in the global economy, this pair will almost certainly rally a bit, and the RBI will probably let it do so.