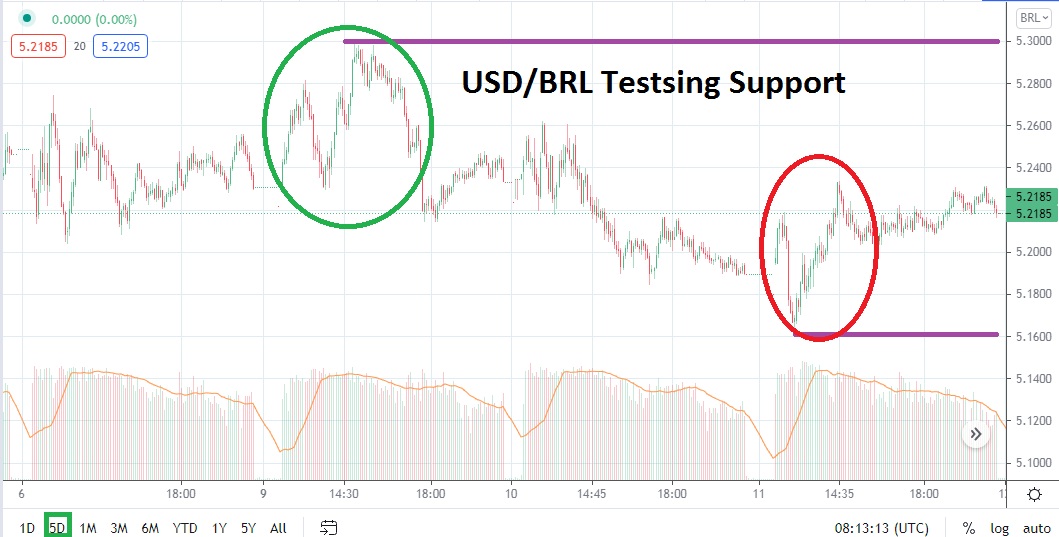

The USD/BRL has delivered another dose of awkward volatility the past few days of trading. On the 9th of August the Forex pair suddenly traded higher and came within sight of the 5.3000 juncture. The last time the USD/BRL had traded above this mark was nearly one month before on the 8th of July. On the 20th of July the USD/BRL also toyed with higher levels and traded near marks of 5.2900. Intriguingly, the on the 8th and 20th of July after coming within sight of these apex junctures, the USD/BRL was able to exhibit a rather strong dose of selling.

Speculators who continue to believe the USD/BRL will once again establish its bearish mid-term trend which was abundant from March until late June may be growing more confident. The notion that the USD/BRL has now seen three reversals lower since early July when the 5.3000 juncture has come within sight should be contemplated. Yesterday’s additional move lower took the forex pair below the 5.2000 mark and actually tested the 5.1600 ratio. Skeptics who remain bullish and on the outlook for constant reversals higher may point to the current price of nearly 5.2200 as evidence another move higher will be demonstrated.

Traders need to keep their eyes on nearby support and resistance levels when the USD/BRL opens for trading today. Resistance near 5.2450 and support of 5.2000 will likely prove crucial as important ingredients for sentiment technically short term. If the 5.2000 is proven vulnerable and global forex continues to display some USD weakness, the USD/BRL may be able to produce a correlated result to the broad market and traverse lower.

If resistance is punctured higher and the 5.2500 level erodes, values near the 5.2700 should be given attention. Speculative bears may view these higher prices as a potential selling ground and look for reversals lower. Certainly resistance near the 5.2800 to 5.3000 levels needs to be monitored. If the 5.3000 ratio is compromised and the USD/BRL move higher, this would be a strong bullish sign. However, the market action the past week suggests that the USD/BRL is potentially about to move lower.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.2440

Current Support: 5.1980

High Target: 5.2720

Low Target: 5.1550