The USD/ARS is traversing an upwards trend and its ability to maintain a bullish stature is nothing to be proud about for the Argentine government. Empty promises of better days ahead for the nation from its leaders, and statistical evidence that nearly 40% of the public is now living below the poverty line are dire realities.

The USD/ARS continues to march higher as the government’s official exchange rate is rattled on a weekly basis. Exchanging the Argentine peso for USD on the streets of Buenos Aires remains the place many citizens of the nation try to actually transact the Forex pair, because the unofficial trading value is nearly twice as high.

Further evidence the government has little inclination to actually loosen the reins of its bad policy was exhibited last month, when the government suddenly changed the rules on the amount of foreign denominated bonds traders in Argentina could purchase. This was seen as another move by the Argentine leadership as an attempt to limit other methods of USD/ARS exchange. Talk about an economic turnaround and growth returning to the nation continues to be whispered too by some optimists, but quantified evidence of better results remains challenging to produce.

Traders who want to buy the USD/ARS are making the correct decision. If a trader can purchase the USD/ARS on their trading platforms as a speculative wager, they must have time parameters in mind. The USD/ARS does not deliver upward momentum on a daily basis, and reversals lower sometimes do occur. Stop losses should be given a wide berth to allow for the cyclical moves downward which are occasionally seen. However, if a trader can hold onto their buying positions and the overnight carrying charges are not huge, buying the USD/ARS remains the practical wager.

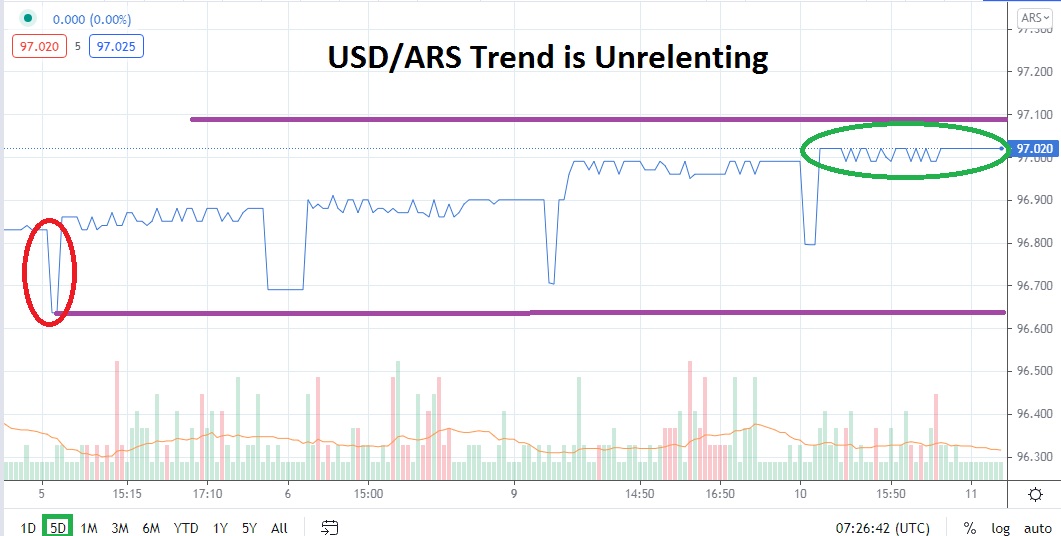

The USD/ARS is unlikely to suddenly develop a prolonged bearish cycle. On the 30th of June, the USD/ARS did demonstrate a violent spike downward, but it quickly reversed back to a ‘normal’ level. Currently, the USD/ARS is traversing above the 97.000 juncture and buyers no doubt have targets in mind of 97.100 and above as legitimate higher goals. The real battle for speculators within this pair is time duration, transaction costs and protecting the trade against the occasional spike lower. Cautious traders should use a conservative amount of leverage.

Argentine Peso Short-Term Outlook:

Current Resistance: 97.100

Current Support: 96.950

High Target: 97.300

Low Target: 96.750