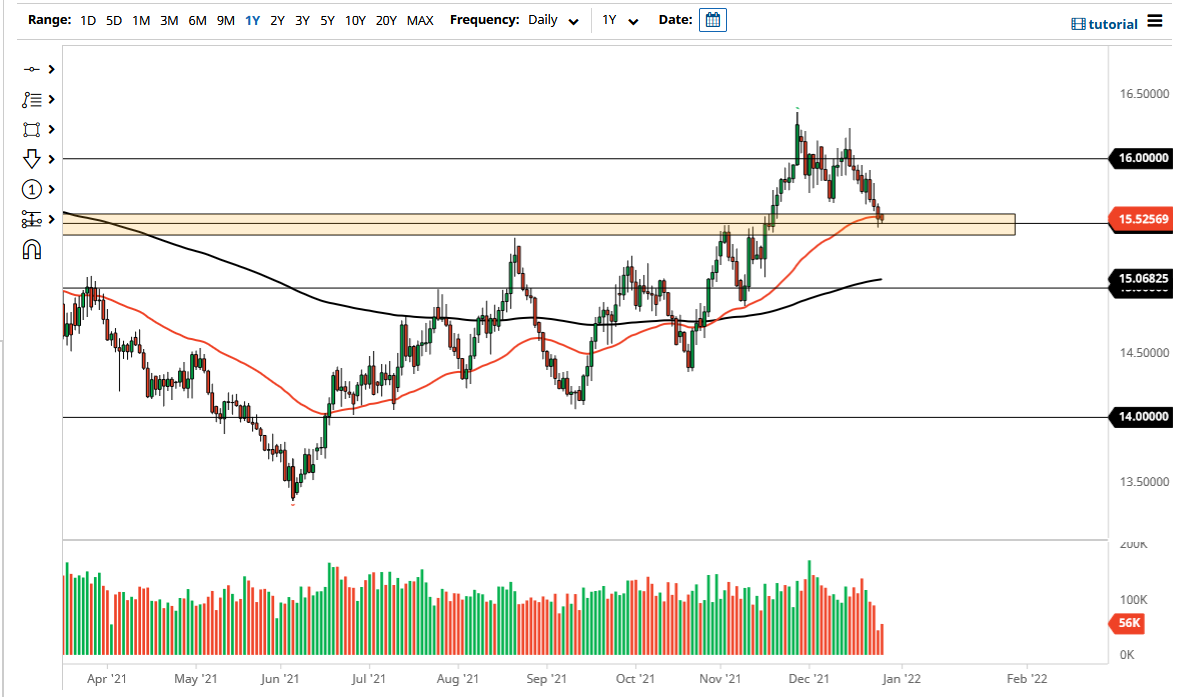

The US dollar has rallied a bit during the trading session on Wednesday to reach towards the 15 South African Rand level. That being said, the market is likely to continue to bang his head against this ceiling in the form of 15, and at this point it looks as if it is only a matter of time before we break out. That is a large, round, psychologically significant figure, so therefore if we can break above there it is likely that the market should continue to go higher and perhaps, we are getting ready to change the overall trend.

The 200 day EMA currently sits at the 14.76 Rand level and is turning slightly higher. All things being equal, we also need to look at the possibility of the 50 day EMA reaching towards the 200 day EMA and possibly trying to cross it to form the “golden cross” indicator that a lot of people like. That is technically the beginning of a longer-term bullish trend, and therefore it is likely that we would go higher at that point, even if it is going to be a very noisy affair.

Keep in mind that the South African Rand has to deal with the emerging-market stigma, as the US dollar has been strengthening against riskier currencies and assets, as we have seen a lot of “risk off” type of behavior due to the Delta variant ravaging through the Third World. Furthermore, the South African political situation has gotten dicey at best, as it appears that South Africa is going to try to go the same route as Zimbabwe, and although it probably does not get quite that bad, we could start to see the South African Rand sell off quite drastically.

There is a bit of an interest rate differential here, but at the end of the day whether or not people are willing to step out on the risk spectrum, which South Africa most certainly as far out there. The US dollar course represents safety, and of course bonds have started to strengthen so therefore it makes quite a bit of sense that we would see the US dollar strengthen as a result. Remember that this pair tends to move in 0.50 ZAR at a time, so on the breakout I would be looking for a move towards the 15.50 ZAR level.