The Consumer Price Index is coming out on Wednesday, and it seems as if the markets are simply waiting to see whether or not we will see nasty inflation or some other type of disappointment. This is a market that I think will continue to find plenty of buyers on dips, which is possible due to the announcement causing a lot of volatility. Furthermore, we also have a lot of support underneath and therefore I think it is only a matter of time before we can get long.

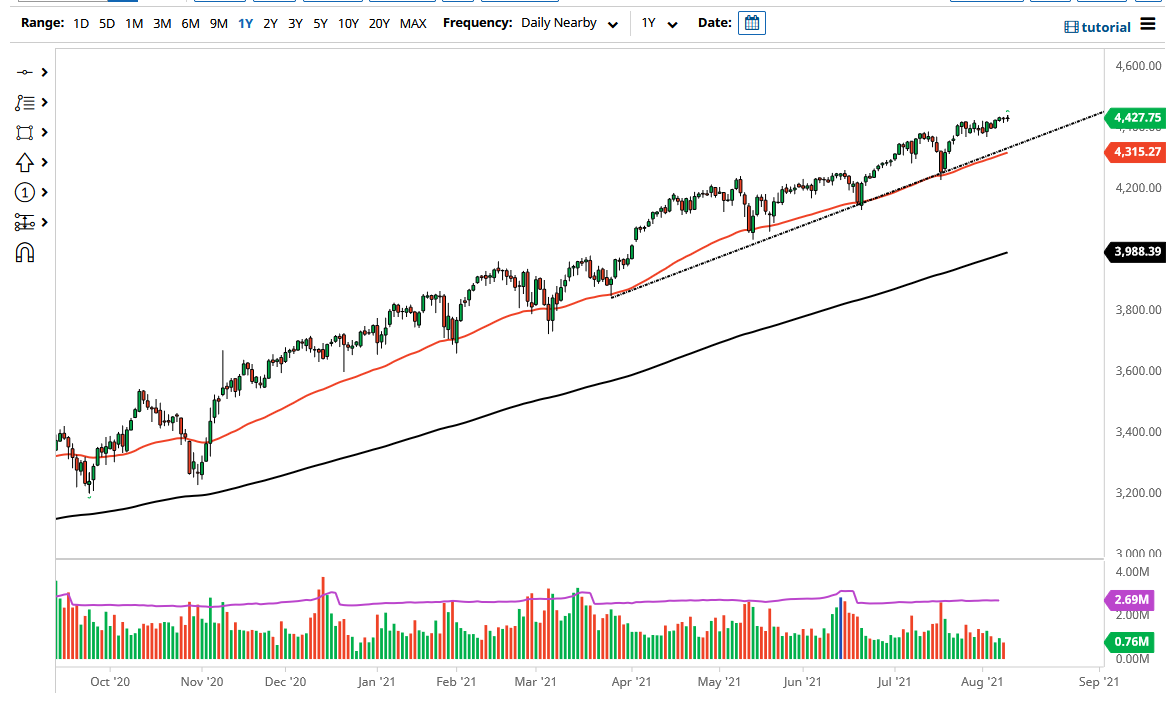

The 50-day EMA is marching right along the uptrend line, and I think it is worth paying close attention to that area. If we do pull back at this point in time, then it is likely that we would see plenty of buyers jumping in. It coincides just below the 4400 level, which in and of itself will cause a certain amount of support as well. I think that we will eventually go looking towards the 4500 level, even the 4600 level.

If we were to turn around and break below the 50-day EMA, then it is likely that we could go lower, looking down towards the 4200 level. The 4200 level is an area where there would be plenty of interest, especially as it is a large, round, psychologically significant figure as the S&P 500 does tend to pay close attention to these levels every 100 points. Even if we break down below there, the market is likely to go looking towards the 4000 handle underneath, which has a huge options barrier sitting there, and the 200-day EMA is reaching towards that area as well.

I look at this as a potential buy value if we do break down, but you need to be aware of the fact that inflation could cause a bit of a headache. The 4000 level underneath would be a nice 10% correction, which is something that the market could use at this point, and I certainly think it will happen sooner or later. That does not necessarily mean it will happen right away, and it certainly does not suggest that you should be short of this market anytime soon. The last couple of days have been very choppy and sideways, so I think at this point we are simply waiting for a catalyst. It might be here in the next 24 hours.