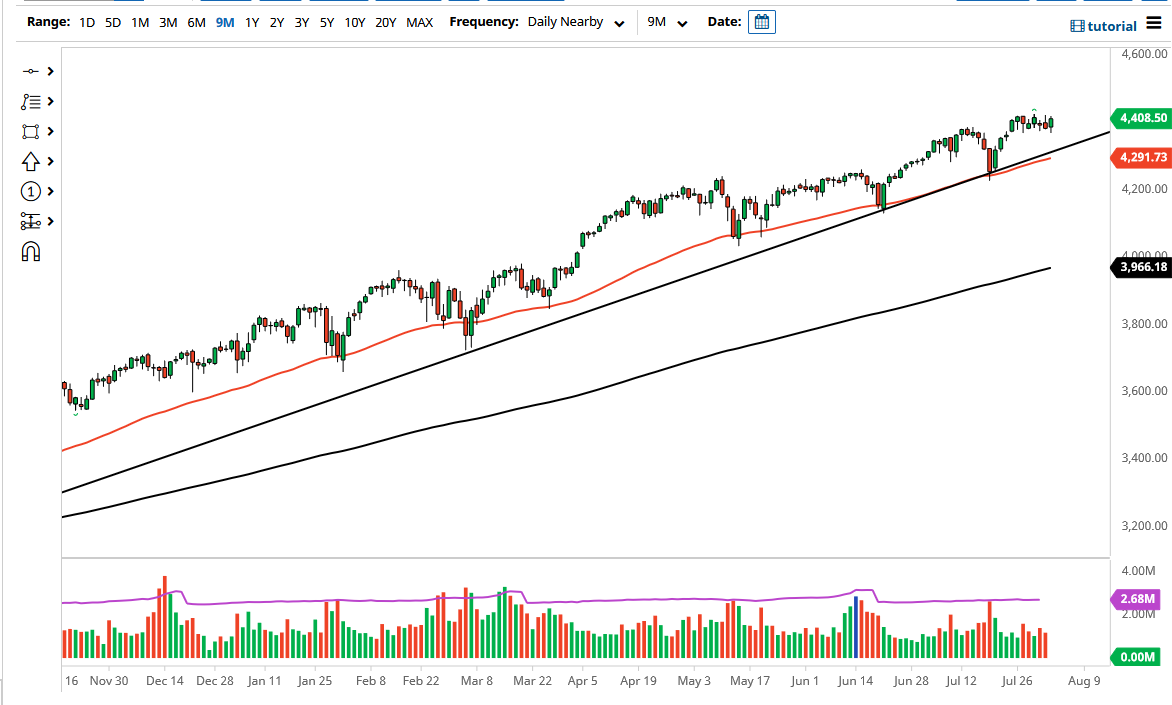

The S&P 500 pulled back ever so slightly during the trading session on Tuesday but then turned around to show signs of resilience. As we continue to hang around the 4400 level, it makes sense that we are simply in a “holding pattern” as we wait to see whether or not we have a reasonable jobs number at the end of the week. Even if we were to break down below the candlestick for the trading session on Tuesday, there is plenty of support underneath that will come into play.

The one thing that I think you should pay attention to more than anything else is the uptrend line and the 50-day EMA that sits just below that. The market has been in an uptrend for quite some time and you could even make an argument for a little bit of an “uptrending channel” over the last couple of months, with that uptrend line being the bottom. Ultimately, it is probably going to be easier for this market to break out to the upside then it would be to break down below that uptrend line; but if it did, then the 4200 level comes into the picture as potential support. After that, I think the “hard floor in the market” is near the 4000 handle where the 200-day EMA is rapidly approaching. That being said, I do not see that happening anytime soon.

On the other hand, if we were to break above the recent highs at 4420, then it is likely we will go looking towards the 4500 level as the S&P 500 still has the “Powell put” in effect, and the Federal Reserve is very unlikely to do anything to upset the apple cart, so to speak. It is very likely that we are going to continue to see upward momentum over the longer term, so I have no interest whatsoever in shorting this market. With the Federal Reserve manipulating everything, it is almost impossible to do so. I think we are simply looking at a scenario in which you need to wait for little bits and pieces of value that you can take advantage of. Over the longer term, I fully anticipate that we will not only reach the 4500 level, but possibly even the 46.