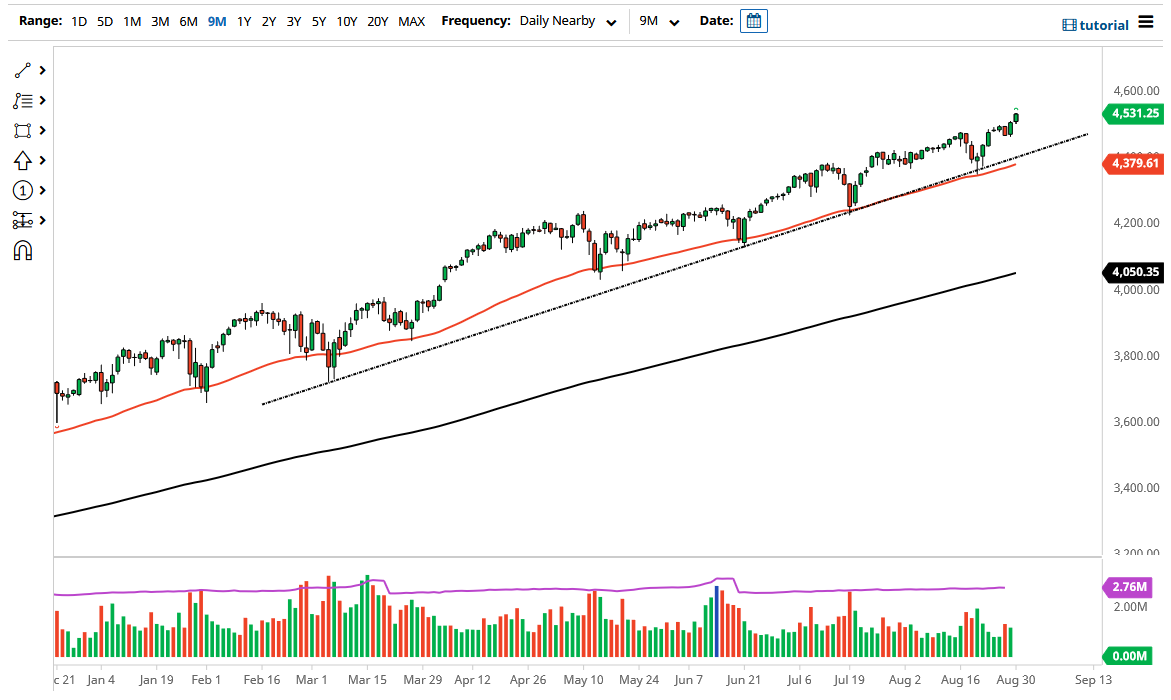

The S&P 500 rallied again during the trading session on Monday to break above the 4530 level. This is a market that continues to move based upon central bank policy from the Federal Reserve, which is very loose. Now that we are above the 4500 level, we will go looking towards the 4600 level over the longer term. Keep in mind that the S&P 500 does tend to move in 200-point increments, so I think that you have to look at it.

To the downside, the uptrend line and the 50-day EMA both offer a significant amount of support, so it is likely that it serves as a “floor in the market” going forward. If we were to break down below there it would obviously change a lot of things, and I would be a buyer of puts. Remember, you cannot short US indices as long as the Federal Reserve is out there pushing the markets higher. If you do not believe me, simply look at any major dip in the stock market since 2008 and read what the Federal Reserve did. They always did something, because at the end of the day, Wall Street is the most important client for them to protect.

I do not mean to sound cynical; I think the word here is “reasonable.” In that scenario, you need to look at this through the prism of either being long or being on the sidelines. Yes, occasionally you can make money on the downside, and I do that through buying puts because I do not want Jerome Powell to say something suddenly that turns the market around and rips my account apart. I have tried to short the market in the past, and the biggest problem with shorting a market that goes up over 80% of the time is that you have to be able to time the exit. That is almost impossible in a scenario where everything is so manipulative.

In that scenario, you have to realize that you can either be flat or long. As we have been impulsive for the last couple of candlesticks, it does suggest that we may drift a little higher before we pull back to find buyers later this week. We have the jobs number coming out on Friday, so the later we get in the week, the more likely we are going to be quiet.