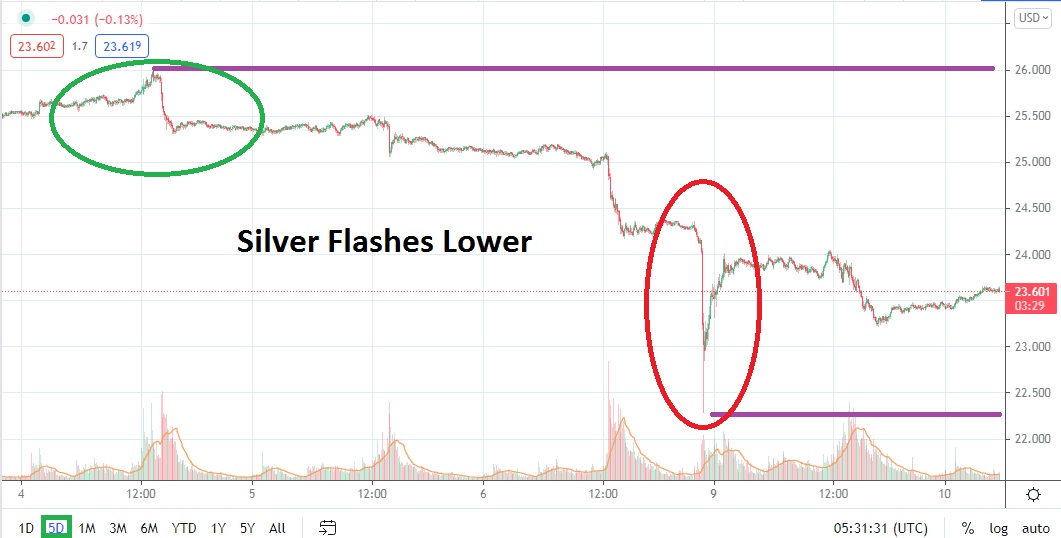

Silver was hit by an abrupt flash crash in early trading yesterday as the commodity sank below the 22.400 price momentarily. Gold was also hit by a massive wave of selling which caused a detrimental spike lower for any speculator who was holding a long position.

The swift move lower by silver yesterday likely knocked many traders out of their positions, particularly if they were using large amounts of leverage and didn’t have enough margin to cover their trading positions. Hopefully the use of a stop loss helped salvage their accounts. However, moments like yesterday make stop losses almost irrelevant, and sometimes cause wicked price fills that produce terrible results.

Intriguingly, if a speculator in silver who was long was able to survive the day, or better yet was lucky enough not to have a buying position in place when the spike lower occurred, may look at today as an opportunity. Yesterday’s abrupt move lower hit silver values not seen since late November of 2020 and the current price has the commodity within the depths of December 2020 prices. As of this morning, silver is near the 23.640 mark, which is below technical lows made in late March of this year.

Traders who have the ability and patience to buy silver within its current price range and can hold onto to their positions with overnight endeavors may find a speculative wager that is worth a chance. Yes, silver can certainly go lower, the commodity hit the 21.600 ratio in September of 2020, but this was also a unique low technically. Commodity prices have been hit by a strong dose of volatility recently as economic concerns regarding demand about the potential effects of the Delta variant of coronavirus create nervousness. Yes, there are other components within the turbulent prices too.

From a speculative viewpoint, silver appears to be in oversold territory for the moment. The recent volatility should serve as a strong reminder that tactical risk management needs to be used and that leverage should be kept conservative. Traders should not expect overnight miracles from silver, but the prospect of buying the commodity and seeking upside price action to develop looks like an endeavor worthy of pursuit for speculators who are still in the game.

Silver Short-Term Outlook:

Current Resistance: 23.950

Current Support: 23.200

High Target: 24.400

Low Target: 22.590