The NASDAQ 100 rallied a little bit on Tuesday as we continue to see a lot of bullish momentum. It certainly looks as if the market is ready to simply continue going higher as traders are betting that the Federal Reserve will not taper bond purchases anytime soon and will continue to keep a very loose monetary policy. The Federal Reserve stepping in and buying bonds will keep interest rates very low, which is good for the NASDAQ 100 as a lot of growth stocks tend to do well in that low interest-rate environment.

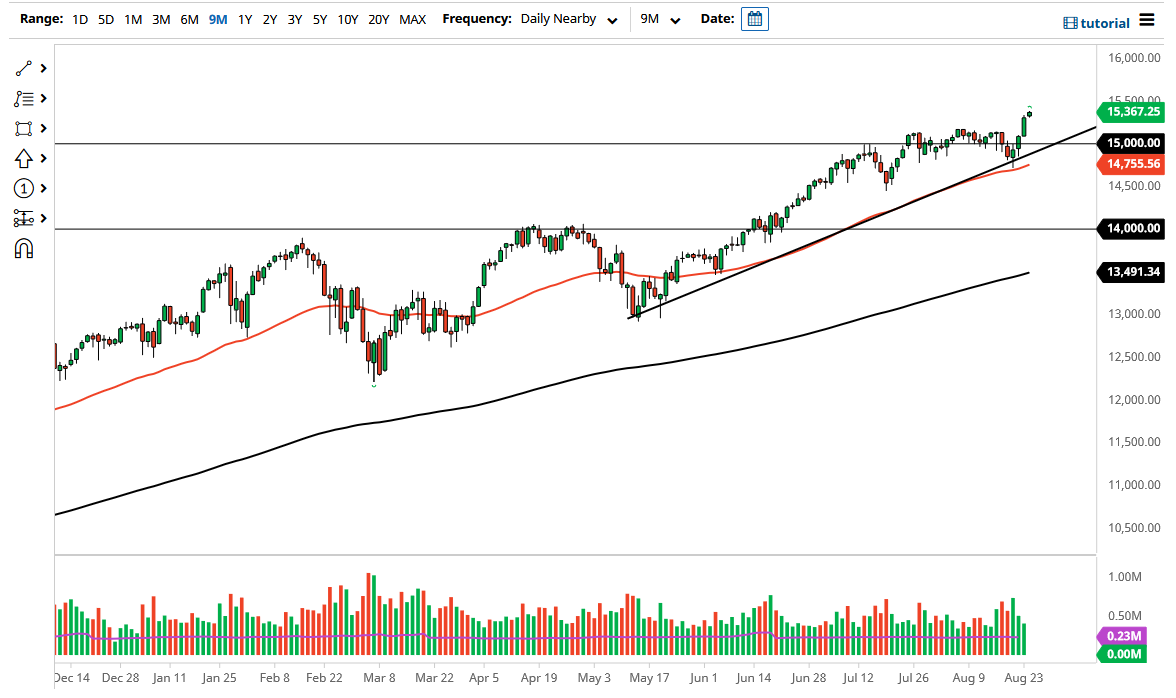

To the downside, the market should see plenty of support near the 15,000 level, an area that has been important in the past as well. Furthermore, we also have an uptrend line and the 50-day EMA coming into the picture, so it all ties together quite nicely with the idea of support coming in on a dynamic and structural standpoint. Furthermore, the 15,000 level will offer a certain amount of psychological support, as numbers tend to pay close attention to these large figures.

If we were to break down below the uptrend line, then it is obviously very negative, and it is likely that the situation would have me buying puts, as simply jumping in and shorting the index has been a great way to lose money over the last 13 years. At that point, I think the 14,500 level would be targeted, followed by the 14,000 level. The 14,000 level is an area where the 200-day EMA is racing towards, so I think it all kind of ties together quite nicely in that area for some type of bounce after a correction. Nonetheless, that is very unlikely to happen anytime soon, so I do think that this market is more likely to see 15,500 than it is to see 15,000 in the short term. Unless Jerome Powell starts talking about tapering later this week, there is not much to keep the NASDAQ 100 from going higher outside of maybe some headline noise coming from the coronavirus front, but the market has looked past that every time it is popped its head into the picture, so I do not see why that would be any different now.