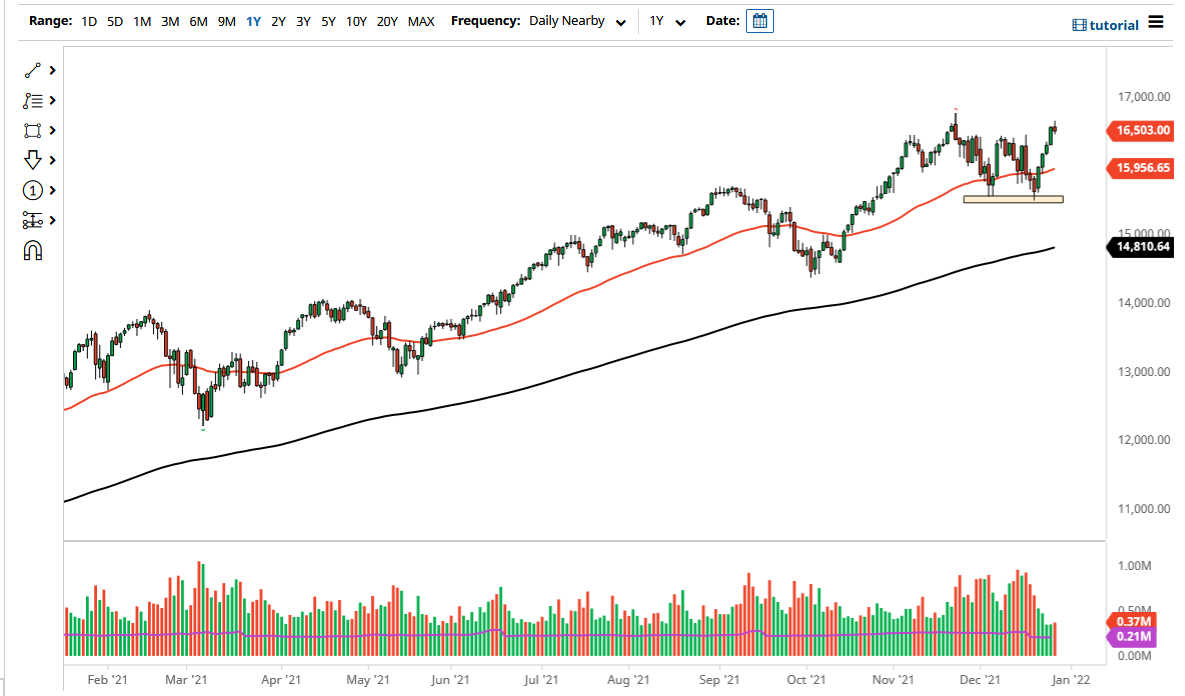

The NASDAQ 100 has rallied a bit during the course of the trading session on Thursday as the uptrend line continues to offer significant support. Furthermore, the 15,000 level of course is an area that would attract a certain amount of attention due to the fact that it is a large, round, psychologically significant figure and an area that has been very attractive for the market over the last several weeks.

Even if we do break down below the uptrend line, it is likely that the market could probably go looking towards the 50 day EMA, which of course is sitting underneath and hiking to the upside. That very same indicator does tend to offer dynamic support and resistance in of course will attract a certain amount of attention. After that, then we would have a reaction at 14,500, and then of course a move down to the 14,000 level would attract even more support. Because of this, I think this is a market that will eventually find buyers, so I look at the idea of a pullback as a value proposition more than anything else.

On the other, if we do break out to a fresh, new high, then the market is likely to go looking towards the 15,500 level, as this market tends to move in 500 point increments, so therefore I tend to look for longer-term swing trades at these increments. Ultimately, this is a market that I think will continue to see a lot of choppy volatility, but I still favor the upside as stocks in America tend to be very highly influenced by Federal Reserve liquidity measures which of course continue to be a major driver.

The interest rate situation in America of course should be paid attention to, and as a result the NASDAQ 100 may lack some of the other indices if we see rates continue to go higher. After all, growth companies do tend to outperform in a low interest-rate environment. Because of this, I think you will have to use the 10 year note rates as a bit of a guide as to whether or not you want to buy the NASDAQ 100, or if you want to buy the S&P 500. In the meantime, I would not short either one of these indices anytime soon.