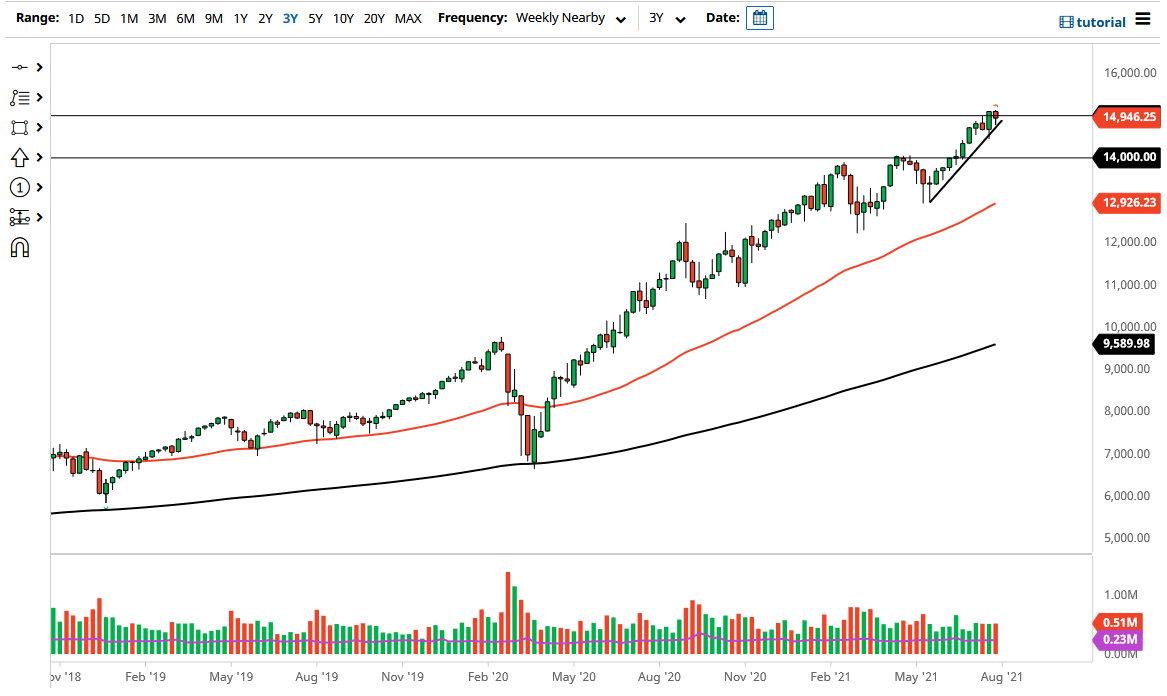

The NASDAQ 100 rallied again during the month of July, but it should not be thought of as an easy month. We had one very strong week, followed by a couple of choppy ones. We are walking right along an uptrend line and flirting with the 15,000 level, which will attract a certain amount of psychology to the market. That being said, it is still very much a bullish market, and it is difficult to imagine a scenario in which that changes anytime soon.

Pay special attention to the 10-year yield, because if yields in America dive, that typically favors high growth companies such as Facebook, Alphabet, Tesla and others that make up the biggest part of the NASDAQ 100, as it is not an equally weighted market index. With that being said, think of this as growth, and I think we will probably continue to see this index lead many of the other ones as yields seem to be falling more than anything else these days.

On a weekly close above the 15,000 level, I think that opens up a move to much higher levels in this market, perhaps allowing the NASDAQ 100 to go chasing the 15,500 level, followed by the 16,000 level after that. The 16,000 level is another round figure that will probably cause a bit of noise, but at the end of the day it is not anything more than a headline. As long as we stay in a low interest-rate environment, it is very likely that these technology giants will continue to propel this index higher.

Looking at central banks, they are addicted to low rates, and I just do not see them allowing rates to rise naturally. Granted, interest rates should be much higher than they are right now, but as long as the Federal Reserve is out there willing to manipulate the bond market by purchases, it is difficult to imagine a scenario in which growth does not do well. Beyond that, people are going to start looking towards the old favorites as there has been a major shift in the economy, and people are trying to figure out whether or not it is completely reopening or if it is going to be one that is a hybrid between digital and analog worlds. Although they have not acted as such over the last 48 hours, it should be noted that most of the large technology firms have reported blowout earnings.