Important US job numbers, and the price of gold may continue to move in a narrow and limited range until these important and influential events pass. The price of gold is stabilizing around the $1,814 level at the time of writing the analysis, as investors tend to buy more as long as it is above the $1800 psychological resistance. All in all, the slight increase in the value of the US dollar may have affected the price of gold along with the news of an increase in Covid-19 vaccinations in the US.

Data published by the Centers for Disease Control and Prevention showed that 70 percent of adults in the United States of America have received at least one dose of the Corona virus vaccine. The increase in vaccinations comes amid the rapid spread of the delta variant of the coronavirus, which has led to renewed lockdowns in some parts of the world.

The CDC recently revised its guidance to recommend that people vaccinated against the coronavirus resume wearing masks indoors in areas of high or high transmission, particularly in the South and West.

China has halted flights and trains, canceled professional basketball matches and announced mass testing for the coronavirus in Wuhan, as the rising delta virus outbreak reached the city where the disease was first detected in late 2019. While the total number of cases is not still in the hundreds, it's far more widespread than anything China has dealt with since the initial outbreak that devastated Wuhan in early 2020, and over time it spread to the rest of the country and the world. China has not eliminated COVID-19 at home, but has greatly limited it through rapid lockdowns and mass testing to isolate infected people whenever new cases emerge. Most previous outbreaks have not spread beyond the city or county. And this time, cases have been confirmed in more than 35 cities in 17 out of 31 provinces and regions in mainland China.

On the economic side, the US Commerce Department released a report showing that new orders for US manufactured goods jumped more than expected in June. The Commerce Department said factory orders jumped 1.5 percent in June after rising by an upwardly revised 2.3 percent in May. Economists had expected factory orders to increase by 1.0 percent compared to the 1.7 percent jump originally recorded for the previous month.

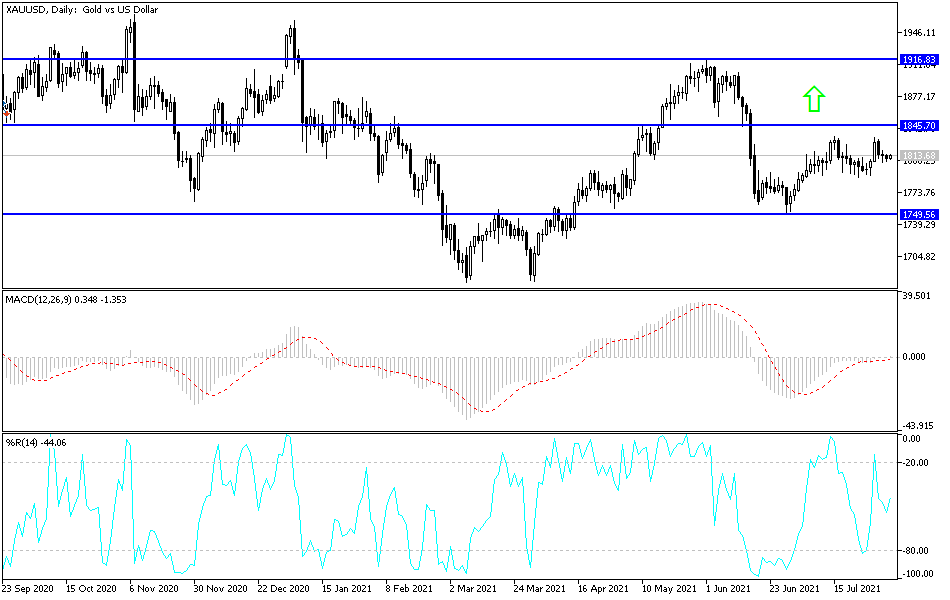

According to gold technical analysis: Sticking to the psychological resistance level of 1800 dollars an ounce is still stimulating the bulls' domination of gold's performance and stimulating buying deals, prices in the waiting mode for any new that stimulates more buying or completing the latest correction. Technical indicators are also neutral. The closest targets for bulls are currently 1819, 1827 and 1845 dollars, respectively. The gold price may give up expectations of rising if it returns to the support level of 1775 dollars, and from below it recommended the return of buying gold.

The gold price will be affected today by the extent to which investors take risks or not, along with the level of the US dollar and the reaction from the announcement of the services sector reading from China, the euro area, Britain and the United States, then the first reading of the US labor market, the ADP survey to measure the change in the number of US jobs.