The GBP/USD is moving in a very narrow range in light of the pound's stubborness in the face of the strength of the US dollar. The dollar strengthened after the impressive US jobs numbers, which showed the extent of the rapid economic recovery from the effects of the epidemic, paving the way for tightening the Federal Reserve's policy. The US Federal Reserve was also matched by optimism about the possibility of tightening the Bank of England policy, which caused the EUR/USD to fall and stabilize around 1.3825 as of this writing.

The policy of global central banks determines the course of the currency market. In this regard, Intesa Sanpaolo stresses that central bank policy is the main driver of currency valuation in the current market environment, as those central banks are likely to raise interest rates before their peers and are therefore likely to see their currencies appreciate. As for the European Central Bank (ECB), the Bank of England (BoE) and the Federal Reserve both lead on this metric. The Federal Reserve appears increasingly ready to announce that it will begin reducing its asset purchase program (tapering) by the end of the year, a development that markets see as increasingly likely following a series of speeches from Fed members this week.

Reducing the asset purchase program of the US central bank is a prerequisite for raising interest rates, and the markets are now anticipating a price hike in late 2022 / early 2023, considering that this will be supportive of the dollar.

In contrast, the Bank of England reformulated guidance on interest rate prospects in its August policy update, saying, “If the economy develops broadly in line with central expectations in its August monetary policy report, some modest tightening of monetary policy will likely be necessary during the period to be consistent with achieving the inflation target sustainably over the medium term.”

The market currently expects the BoE rate to rise around mid-2022, but the Bank's own expectations on inflation and economic growth must be met to keep the schedule alive. Therefore, the pound may be more reactive to the data than it has for some time, especially now that the Brexit political risk premium that has weighed on the currency since 2016 has largely evaporated. Also, Britain's GDP figure for the second quarter and month of June is expected this Thursday, and is one of the most prominent events this week for the pound sterling.

The market expects UK GDP growth to rise 5.0% quarter-on-quarter, after contracting 1.6% in the first quarter. The Bank of England said in its August monetary policy report that it now expects growth of 7.25% in 2021, 6% in 2022, and 1.5% in 2023. This is up from 7.25%, 5.75% and 1.25%, respectively, in the monetary policy report for the month of May.

Beyond the GDP numbers, keep an eye on the very important inflation readings on August 18th. The British Bank's August monetary policy report saw economists revise their inflation forecasts to 4% in 2021, 2.5% in 2022 and 2% in 2023 from 2.5%, 2% and 2% respectively in its May monetary policy report.

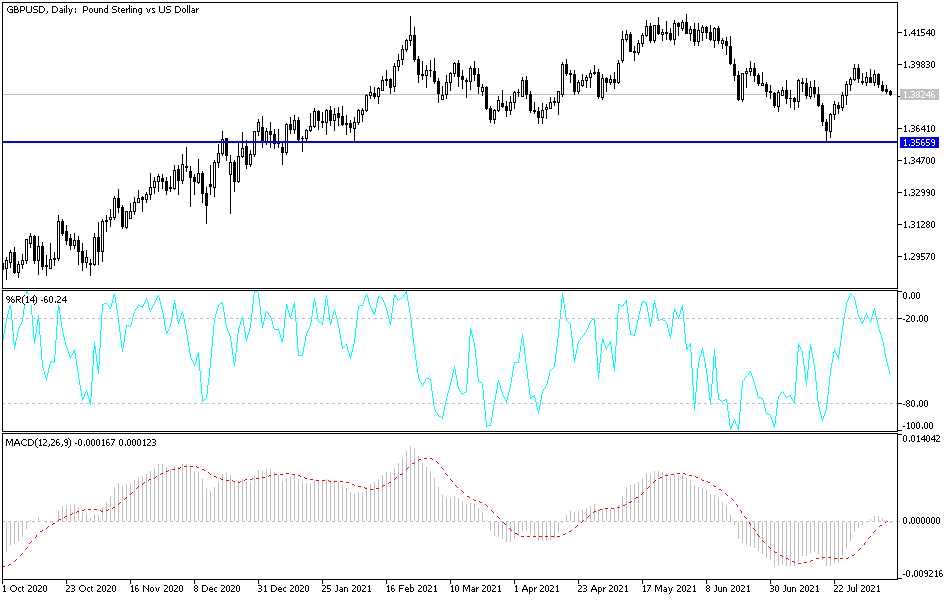

Technical analysis of the pair

The GBP/USD currency pair may abandon the current resistance if the bears move the pair to the support levels at 1.3755 and 1.3680. I still prefer buying the currency pair from every bearish level. The bulls will regain control of the general trend by moving back towards the psychological resistance level at 1.4000, which may happen immediately after a move towards the 1.3920 resistance.

Today's US inflation figures and the British economy's growth rate tomorrow will be the main movers of the currency pair for this week.