Prior to this important event, the bulls succeeded in pushing the GBP/USD currency pair to the resistance level of 1.3983, its highest in a month, before closing last week's trading, stable around the 1.3907 level. The dollar's losses against the rest of the currencies came as a reaction to the dovish announcement by the Federal Reserve last week. Since last December, the US Federal Reserve has indicated that it will continue to increase its holdings of Treasury securities by $80 billion per month and mortgage-backed securities by at least $40 billion per month until significant additional progress is made toward maximum labor market and price stability goals. Since then, the US economy has made progress toward these goals, and the committee will continue to assess progress in quantitative meetings at $120 billion.

Many analysts see September as the most important month as the Fed's management decision and details are likely to be made, although some recently suggested that Governor Jerome Powell might announce something next month at the annual Jackson Hole Symposium. Powell's remarks at last week's press conference seemed to clarify, however, what he had already indicated in the Fed's official statement; that at least one more meeting is necessary before you can make a change.

Some analysts believe that the pound sterling was one of the best G10 currencies last week, as it decoupled from the dynamics of global risk appetite and may be supported by a slowdown in Covid-19 cases in the United Kingdom, which raises hopes that the government's decision to lift almost all restrictions was adding an interest rate hike in the future.

Dr. Anthony Fauci, the top infectious disease expert in the United States of America, warned of "some pain and suffering ahead" as coronavirus cases continue to rise. He stated on ABC's "This Week" program, that he does not expect more closures in the United States, but warned that the situation surrounding the Corona virus pandemic will continue to deteriorate because many Americans are still not immune. While this week the nation saw a surge in the number of Americans getting vaccinated, with a spike in coronavirus cases driven largely by the more contagious delta formula, only about 60% of Americans are still fully vaccinated.

In contrast, more than 90% of adults in Britain have received at least one dose of the vaccine, the rate for people between the ages of 18 and 30 is about 60%, according to government statistics.

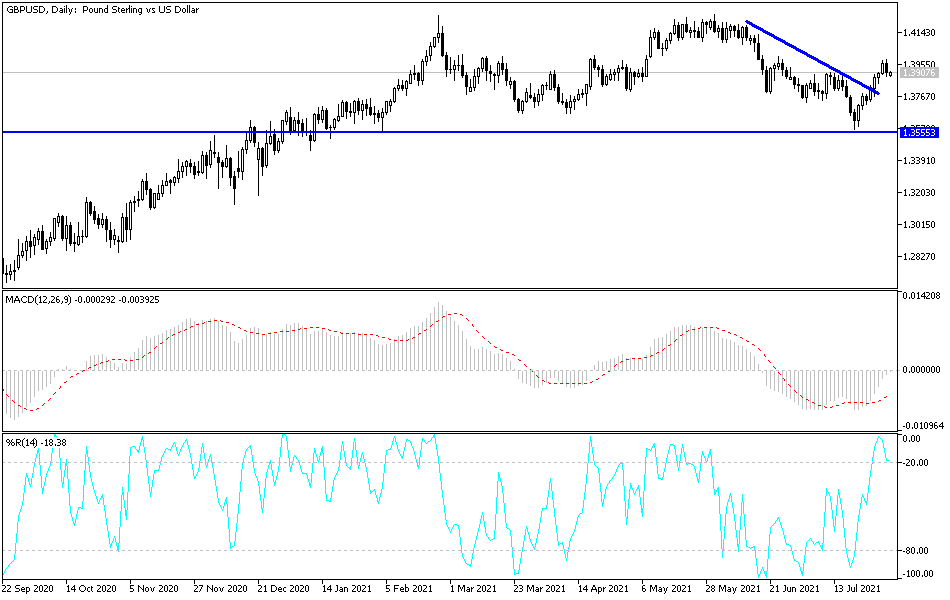

According to the technical analysis of the pair: On the daily chart, the price of the GBP/USD currency pair is still within the range of a bullish channel that it formed recently, and the bulls are waiting to break through the 1.4000 psychological resistance to confirm control and thus increase technical buying positions to test higher tops. The closest targets are 1.4000, 1.4085 and 1.4165, respectively.

On the downside and over the same time period, the bears will return to control the performance if the currency pair moves towards the 1.3775 support level again. The currency pair will be affected today by investor sentiment towards the upcoming Bank of England decisions, as well as reports of Corona virus infections, especially in Britain, as well as the reaction from the announcement of the British Industrial PMI reading. During the US session, the ISM Manufacturing PMI and Construction Spending Index will be announced.