Yesterday's session, the pair was moving in a narrow range between the resistance level 1.3932 and the level of 1.3884. Despite the halt in gains, the 1.4000 psychological resistance is still the most important for the bulls to control. The British pound has outperformed many currencies including the US currency recently with the surrendered Coronavirus which is widely cited to improve appetite among institutional analysts, investors and traders, which could keep the GBP/USD pair in full swing higher for the coming days.

The decline of the Corona virus in Britain paints a picture of the stark contrast between the fortunes of the UK economy and those of other countries including Australia, Japan and many other countries currently mired in renewed or rising waves of infection with the variants of Covid 19. The dollar's decline also plays a role, after the Federal Reserve's decision last Wednesday, the pound rose again above $1.39. Commenting on this, Zack Bundle, FX Analyst at Goldman Sachs says, “The FOMC advanced the declining discussion without changing the schedule, removing a potential source for the dollar's rally. However, the meeting confirmed that the Fed is heading towards an exit, with less concern about the delta variable, and these plans are likely to be more firm if this week's payroll report is as strong as expected.”

“Although the fog may start to fade a bit, we expect the dollar to be range-bound against the G10 for a bit longer, and we will wait for more clarity on these issues before re-engaging in our fundamental bearish view of the dollar again,” the analyst adds.

US Central Bank Chairman Jerome Powell and his colleagues at the Federal Open Market Committee (FOMC) have officially begun to provide the "advance warning" that was confirmed before any final decision to announce the reduction of the bank's $120 billion per month quantitative easing (QE) program, indicating that the start of a process that will lead to “more and more clarity as we move forward,” through the upcoming FOMC policy meetings.

The pound appreciation against the dollar was the natural reaction to the Fed's guidance suggesting that more than one other Fed meeting may be needed before US policy makers are satisfied with a change that would steadily reduce the Fed's massive bond-buying program. This somewhat negated previously escalating suggestions that the bank might make such an announcement in September, if not sooner.

Fed Governor Lyle Brainard, one of seven permanent voters on the twelve-member FOMC, says: “In upcoming meetings, we will continue to assess progress and the conditions under which it would be appropriate to begin to reduce the pace of our asset purchases. “. “It is important to underscore that substantive progress will determine when the committee begins reducing the pace of asset purchases that differ from the cap on employment and inflation outcomes found in future policy rate guidance,” Brainard later said.

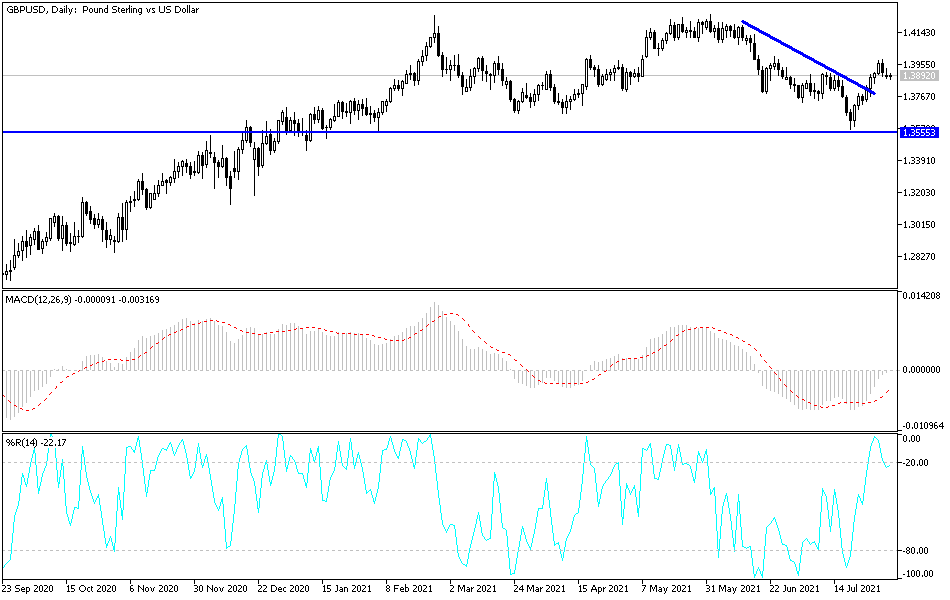

Commenting on the performance of the GBP/USD pair, Karen Jones, Director of Currency, Commodity and Bond Analysis at Commerzbank said, “GBP/USD rose again to reach the 55-day moving average at 1.3967. Between here and the 1.4018 pivot we allow the initial failure (we have warning signs on the intraday charts). Intraday lower dips are likely to be supported around 1.3800.”

According to the technical analysis of the pair: On the daily chart, the breakout of the general upward trend for the GBP/USD currency pair is still valid and the bulls still need to test the resistance levels 1.4000 and 1.4090 to strengthen the current ascending channel. At the same time, on the downside and according to the same time period, the bears' move towards the 1.3740 support level will be important to return to control the trend again, and accordingly to the current bullish expectations. The currency pair is not awaiting any important and influential economic data today, and accordingly, the factors mentioned at the beginning of the analysis have a strong and direct impact on the trends of the sterling dollar pair.