The strength of the US dollar from the latest US job numbers was offset by the announcement of a decline in British infections. This helped the GBP/USD pair hold on, despite the decline of the rest of the other major currencies against the US currency. The currency pair's losses last week did not exceed the 1.3862 level and closed trading around the 1.3875 level. Attempts to rebound higher last week brought it to the level of 1.3958, close to the 1.4000 psychological resistance.

Data released on Friday showed that the latest wave of cases in the UK's Delta variant has eased, with the number of people testing positive for COVID-19 declining across most of the country. Based on the weekly survey of infection levels, the Office for National Statistics said infection rates appeared to be declining in England, Scotland and Wales, but not in Northern Ireland, with the largest declines in younger age groups.

Public health experts credit the UK's successful nationwide vaccination program for slowing the spread of COVID-19 even in the face of the more contagious Delta variant, which was first discovered in India and is now the predominant form of the disease in Britain. With nearly 74% of adults now fully vaccinated, the government plans to expand the program to include teens.

The government reported 31,808 new infections across the UK on Friday, down 42% from the peak of the third wave in mid-July.

But many scientists warn that infection levels are still too high for complacency and that the numbers reported may be inaccurate due to low testing. Over the past week, the UK has reported an average of 26,513 new cases per day, up from less than 2,000 per day in late April. It still has the second-worst pandemic death toll in Europe after Russia, with more than 130,000 confirmed deaths.

The Guardian reported on Friday that Johnson had been in close contact with a staff member who later tested positive for COVID-19, which should require Johnson to self-isolate for 10 days under rules designed to combat the disease. But Johnson's refusal to isolate himself has drawn criticism from the opposing Labor Party, which he says is another example of "a rule for them and one for everyone else". The drop in infection rates in the UK has surprised some scientists. Many expected a sharp rise this summer after the government lifted most remaining lockdown restrictions on July 19.

In addition to the low number of cases, the pound is drawing support from the Bank of England's relatively hawkish statement, as the Bank of England hinted that policy could be tightened to keep inflation in check. The Bank of England's August policy report revealed that inflation will likely be above the 2.0% target rate for the next three years. The Bank of England and economists are concerned that ending the UK jobs support plan in September will lead to higher unemployment.

Therefore, the October release of the jobs report will prove to be an early indication of whether the bank is right to be concerned about rising unemployment.

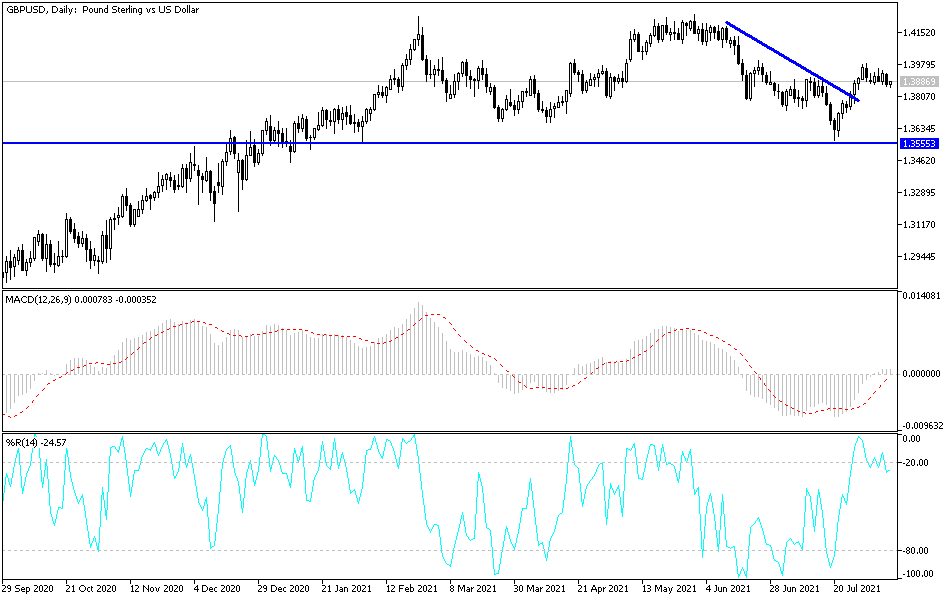

Technical analysis of the pair

GBP/USD formed lower tops and found support around 1.3900, forming a descending triangle on the short-term chart. The price is currently testing the resistance, still deciding whether to break the uptrend line or return to support. So far the 100 SMA is still above the 200 SMA, confirming that there is a chance to go up despite the US dollar's recent gains.

However, the gap between the technical indicators is narrowing to reflect weak upward pressure and a possible bearish crossover. In this case, the GBPUSD may fall back to triangle support again. Stochastic is also moving lower to confirm the presence of selling pressure, and the oscillator has room to move lower before indicating oversold areas. The Relative Strength Index is moving neutrally.