Bearish View

Set a sell-stop at 1.3650 and a take-profit at 1.3550.

Add a stop-loss at 1.3750.

Timeline: 1.3 days.

Bullish View

Buy the GBP/USD and add a take-profit at 1.3900.

Add a stop-loss at 1.3650.

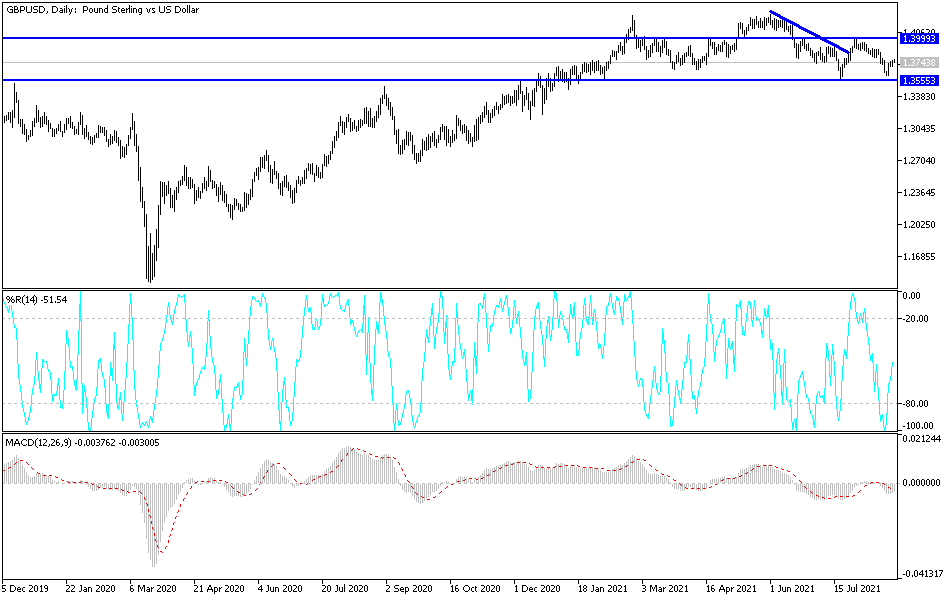

The GBP/USD price was little changed in the overnight session as focus shifts to the virtual Jackson Hole summit that kicks off today. The strong US economic numbers and the risk-on sentiment has played a role in the pair. It is trading at 1.3745, which was still above last week’s low of 1.3600.

Strong US Data

This week, the US has published several important positive economic numbers. On Monday and Tuesday, the statistics agency published strong new and existing home sales, respectively. These numbers provided additional evidence that the American economy is doing relatively well.

On Wednesday, data by the Department of Commerce showed that the country’s durable goods orders were doing well. To be precise, the headline durable goods orders declined by just 0.1% in July, which was better than the median estimate of -0.3%. Core durable goods, which excludes the volatile food and energy products, rose from 0.6% in June to 0.7% in July.

Later today, the US will publish the second estimate of the second quarter. The numbers are expected to show that the economy expanded by about 6.7% in the quarter. The first estimate showed that the economy expanded by 6.5%, which was lower than the median estimate of 8.0%. The US will also publish the second-quarter personal consumption expenditure (PCE) data and initial jobless claims numbers.

The GBP/USD will next react to the latest Jackson Hole symposium that will take place virtually. In this event, central bankers like Bank of England’s (BOE) Andrew Bailey and Federal Reserve’s Jerome Powell will deliver their addresses. With no meetings scheduled this month, analysts will use these events to learn more about these central banks’ plans. The next key data to watch will be the July PCE number that will come out on Friday.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD pair has formed an inverted cup and handle pattern. Indeed, the recent rebound can be said to be part of the handle section of this pattern. The pair has also moved slightly above the pivot point and the 25-day and 15-period weighted moving averages.

Therefore, because of the inverted cup and handle, the pair will likely resume the downward trend. This view will be validated if the price declines below the lower side of the cup at 1.3600.