The British pound rallied quite significantly on Monday as traders sold off the US dollar in general. After all, the Jackson Hole Symposium will create headlines when it comes to the greenback, so it makes sense that a lot of traders are simply trying to cover shorts and other currencies if for no other reason than the potential volatility during the statements.

Central banks have a long history of announcing important statements and policy decisions at the Jackson Hole Symposium, and as there are so many different people looking at the possibility of tapering later this year by the Federal Reserve, the US dollar has seen a lot of strength. That being said, the market will probably hang on any words coming out of Jerome Powell when it comes to the idea of tapering later this year. If he does reiterate the idea that a lot of Federal Reserve governors had stated, which is that tapering could happen between now and the end of the year, that will obviously drive up the value of the US dollar. If that is going to be the case, then this pair will turn around and melt down.

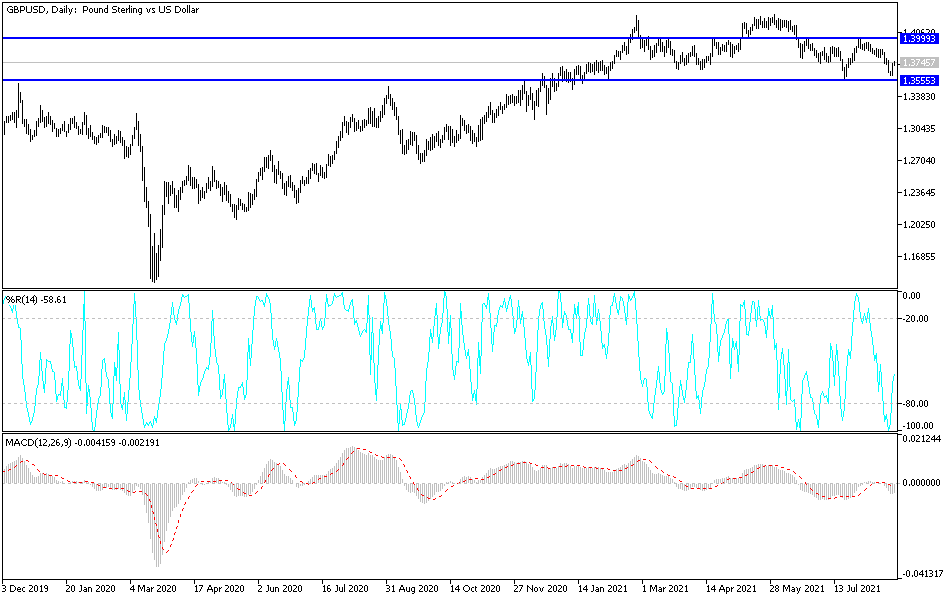

Nonetheless, we are closing towards the top of the range, so I do think that we will probably continue to go higher, at least for the short term. I recognize that the 1.3750 level has been an important level on short-term time frames, and we have the 50-day EMA above there that could come into the picture as well. In other words, I think the upside is somewhat limited, but if we were to break above the 50-day EMA then it is likely that this market could go much higher. In that scenario, the 1.40 level could be tested, but that is an area that has been very difficult to overcome, so really at this point in time I think that if we were to get to that area, sellers would reemerge.

I think this comes down to the next thing that Jerome Powell says, so one would have to believe that he is going to be very cautious with this statement. There is probably a certain amount of short covering in the meantime, so that might lead to a little bit of follow-through until we get words coming from him.