The British pound rallied a bit on Tuesday, breaking above the 200-day EMA quite easily. However, we gave up those gains later in the session as we hesitated a bit heading into the close. This is interesting, because we have the Jackson Hole Symposium this week, which will have a major influence on what happens next with the US dollar. This is a market that continues to hang out and wait for some type of directionality, and perhaps more importantly, you should recognize that this is a market that moves upon the US dollar more than anything else.

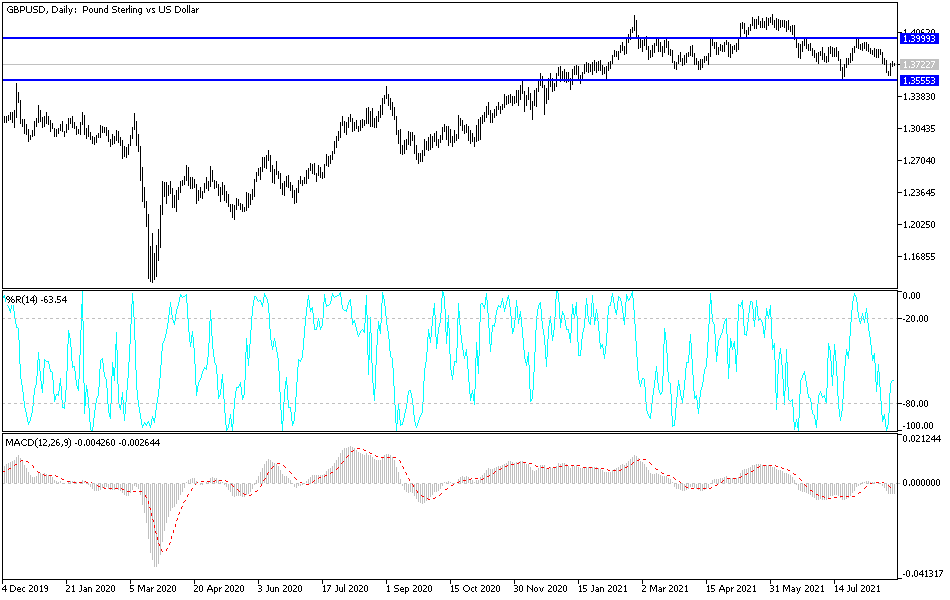

At this point, if we were to break back below the 1.37 handle, it is very likely that we will go looking towards the 1.36 level, which was where we had bounced from. That was a pretty impressive candlestick on Monday, but the Tuesday candlestick has left a lot to be desired. It is also worth noting that gold was very quiet today as well, after rallying quite significantly on Monday. This gives you an idea as to what is going on with the US dollar, and I think at this point we are trying to find a good level to simply churn back and forth.

If we were to somehow break down below the 1.36 level, then it is likely that the market could go looking towards 1.35 handle, which is a large, round, psychologically significant figure and an area that has been important more than once. Breaking down below that opens up the floodgates, and the British pound will probably melt down at that point. That being said, if we turn around and break above the top of the 1.3750 area, then we could go looking towards the 50-day EMA above, which is closer to the 1.3840 handle. That is the least likely of scenarios at the moment, unless the Federal Reserve comes out and suggests that further tapering is going to happen. At this point, I think there is a lot of “risk-off” out there, and I think we are probably looking at a scenario in which we are going to fade rallies sooner or later. I would be cautious with my position size between now and the end of the week though.