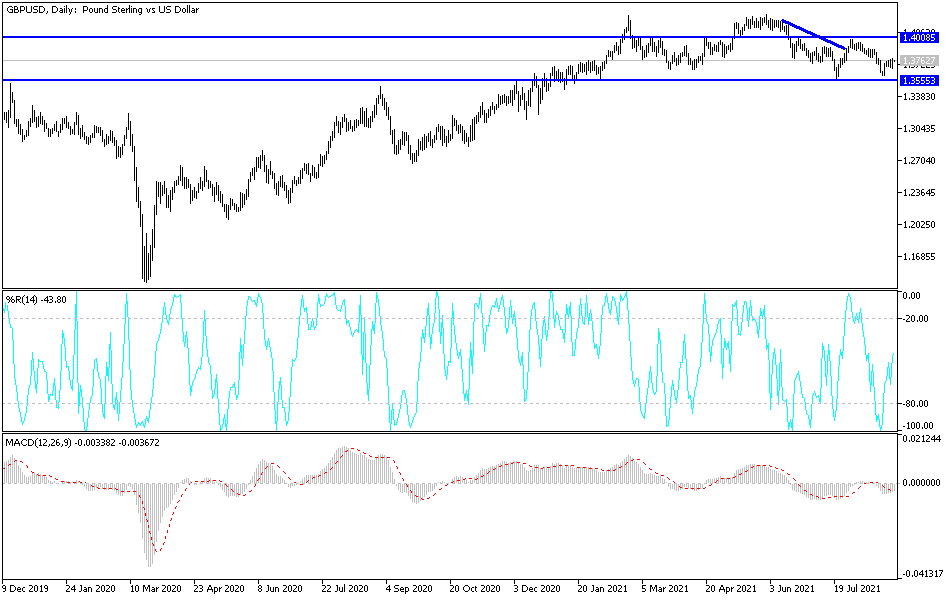

The British pound rallied a bit on Friday as the 1.37 level has offered support, just as it has a few other times. The 200-day EMA has also come into the picture from a technical analysis standpoint, so it does make sense that we would see a bit of a bounce. By doing that, the market looks as if it is trying to save itself, after forming a significant “double bottom.”

The market could go looking towards the 50-day EMA from here, but there is a significant amount of resistance just above, especially right around the 1.3850 handle. That is an area where we had seen a lot of selling previously, mainly due to some Federal Reserve members talking about tapering in a much more hawkish sense than Jerome Powell did at the Jackson Hole meeting. Because of this, the Federal Reserve looks as if it is just as confused as ever, and the massive selloff that occurred in multiple currencies has been replaced by a recovery. In other words, we have gone back and forth all week, to simply make a massive headache for most traders.

If we were to turn around and break down below the lows of the Friday session, that could open up a move down to the double bottom, which is at the 1.36 handle. Breaking down below that level then opens up the possibility for a move down to the 1.35 handle. The market breaking down below the 1.35 level would be extraordinarily negative, opening up a flood of selling. That would obviously be a major “risk off event”, but after the last couple of days it certainly looks as if that is much less likely to happen anytime soon. I think at this point we are more likely than not going to see a lot of noisy and choppy behavior, which will only cause headaches for most people as there is no definable trend in the short term. Eventually, we will see traders coming back from holiday as we get deeper into September, perhaps offering a little bit of clarity, but I would not hold my breath for it in the short term. Because of this, keep your position size small or you could get chopped up rather quickly.