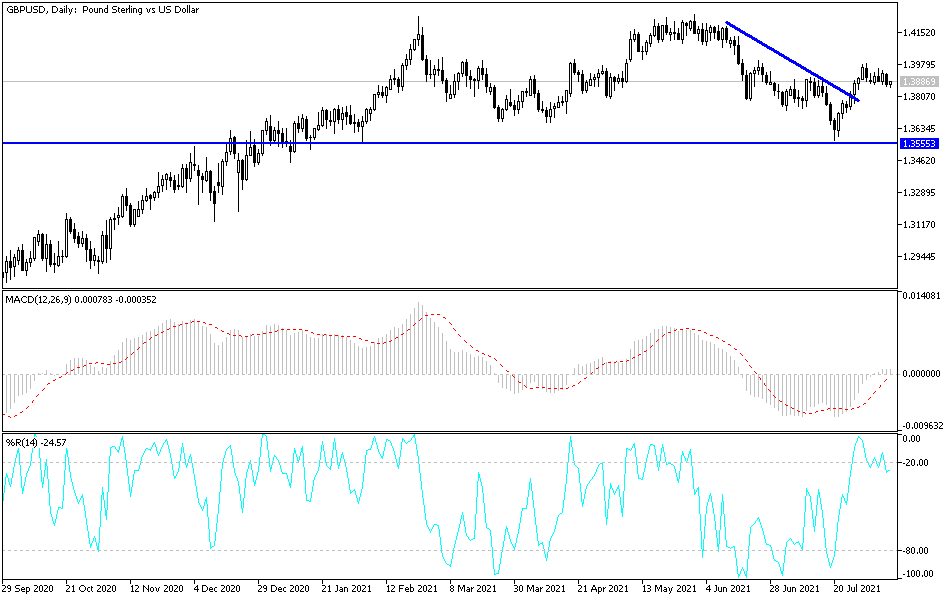

The British pound continued to see a lot of choppy back-and-forth trading on Friday as the US dollar strengthened against most currencies. However, the British pound has held its own against the dollar in the sense that it did not break down. Regardless, we are closing towards the bottom of the range, and it does suggest that perhaps we may have a breakdown coming.

If we were to break down below the 1.3850 handle, then the market is likely to go looking towards the 1.37 level underneath. The 1.37 level is backed up by the 200-day EMA, and I think it makes that a very important level to pay attention to as well as a potential target on a breakdown. On the other hand, the market rallying from here could have the British pound looking towards the 1.40 handle again, an area that has been almost impossible to break out of.

When I look at this chart, there are a couple of different possibilities forming. The first one is a bullish flag, but we would need to break above the 1.40 handle in order to make that happen. Needless to say, that could open up a move towards the 1.42 handle. The market breaking down below could open up a rather significant move lower, and that would be the consolidation and breakdown scenario. Ultimately, a lot of this comes down to the US dollar and what it is doing, not so much the British pound.

Pay close attention to those 10-year yields, because if they start to spike again like they did on Friday, that might be reason enough for this market to come undone. On the other hand, if we see a complete reversal, the market is likely to continue seeing an attempt to break above that 1.40 handle, something that would be almost impossible to imagine being easy. Nonetheless, if we do break above there, it would be impressive enough to send a lot of money flowing into this market. I think the only thing you can probably count on is short-term choppiness followed by an impulsive candlestick, which you need before you put money to work. I do not know when that will happen, but markets do not sit still forever so we should have an opportunity to make a trade eventually.