The British pound fluctuated on Monday as traders try to figure out what we are going to do next. Keep in mind that Friday will have the jobs number from America, and that will have a major influence on markets in general. If that is going to be the case, then it is likely that we will see a bit of hesitation when it comes to making big moves right now, as the jobs number will obviously have a major influence on the Federal Reserve.

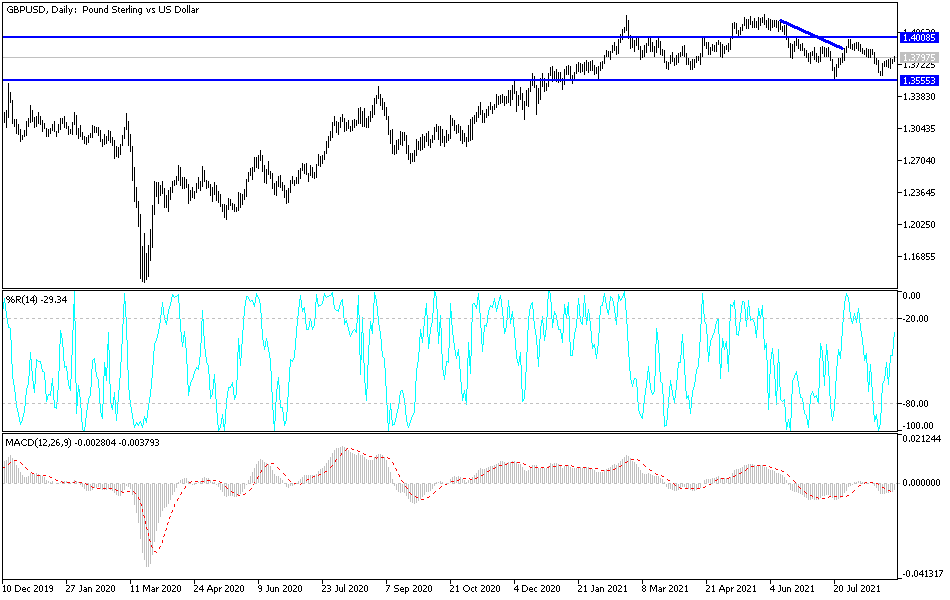

Looking at this chart, the 200-day EMA is flat and suggests that we are going nowhere in the short term. The 1.36 level underneath continues to be support from what I can see, as we have essentially formed a little bit of a “double bottom”, so the question now is whether or not it will hold. Breaking down below that level would kick off fresh selling, perhaps sending this market down to the 1.35 handle. That is an area that has been important multiple times on longer-term charts, so you should pay close attention to it. Breaking down below there could open up a bit of a “trapdoor” in the market.

I believe that by the end of this week we may have a bit of a “heads up” as to where we are going next. If we can break above that 50-day EMA at the 1.3025 level, then it is likely that the British pound will make another move towards the 1.40 handle. That is a major area that has been resistive in the past so I would anticipate that it should be so in the future. I do not think we can break above the 1.40 handle without some type of major catalyst to get the markets “anti-US dollar.”

I think the one thing you can probably count on is a lot of choppy short-term behavior, so I would not get “knee-deep" in your position. The market continues to hear a lot of noise in general, and I think that will be the case for the remainder of the week, not only in the British pound but other currencies as well. At this juncture, you should keep in mind that this is “holiday week” for a lot of traders around the world.