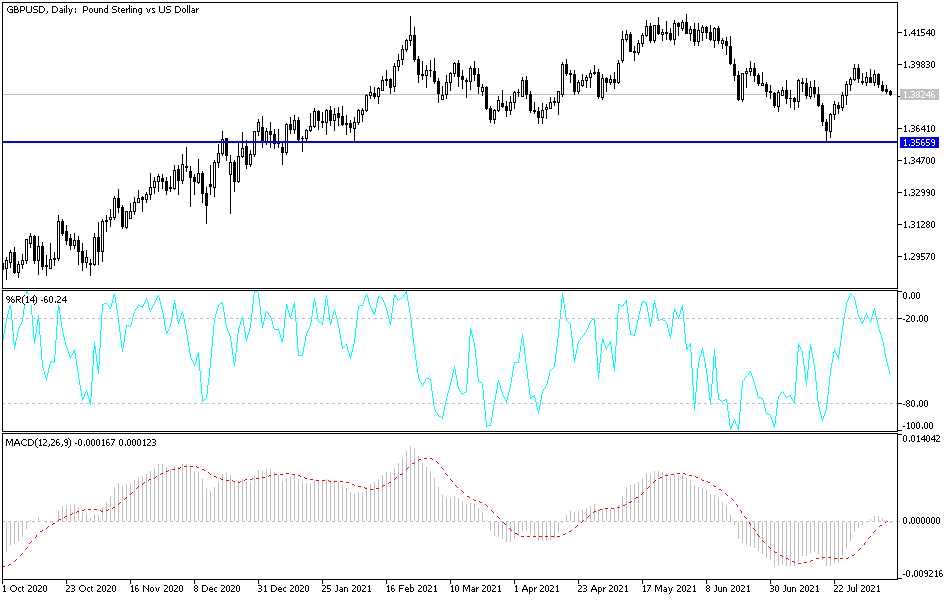

The British pound initially tried to rally during the trading session on Tuesday but gave up all of the gains at the 50-day EMA yet again. The market looks as if it is ready to continue going lower, and as we head towards the CPI figures on Wednesday, we could get a bit of a pop in one direction or the other. Ultimately, this is a market that I think will have to make a decision based upon the idea of inflation, which will move the US dollar itself. I do not necessarily think that this market right now has anything to do with the British pound per se; it is more about the US dollar in general.

Pay close attention to the 10-year note, mainly because the interest rates will give us a heads up as to whether or not the market believes inflation is going to get better or worse. As long as inflation continues to go higher, it should start to raise rates in the 10-year note, thereby making owning US dollars a bit more attractive. Furthermore, there is also an argument to be made that there is a shortage of dollars in the system, as far too much of them are still stuck in the Federal Reserve banking system in the form of banking reserves.

To the upside, the 50-day EMA comes into the picture as resistance, and I do think that a lot of people will be paying close attention to that. If we break above there, then it is likely that we will make a move towards the 1.40 handle above, which has been very difficult to overcome as of late. Initially, this looked as if we were forming a bit of a bullish flag, but right now it is looking more and more likely that we are going to slump rather than rise. Underneath, I believe that the 1.37 level continues to be significant support, especially as the 200-day EMA sits right there as well, which in and of itself will attract a lot of attention. In general, I think by the end of the day on Wednesday we should have quite a bit of clarity going forward, something that we have lacked for a while now. That being said, I still favor the downside.