More bearish pressure pushed the EUR/USD to the support level of 1.1710, its lowest of 2021. The bearish pressure stems from expectations of raising US interest rates amid an econoimc recovery, European fears of the rapid spread of the Delta variant and the continuing loose monetary policy of the European Central Bank. Yesterday, survey data from ZEW, the Leibniz Center for European Economic Research, showed that German economic confidence deteriorated more than expected to a ten-month low in August.

The ZEW Economic Sentiment Index for Germany fell to 40.4 from 63.3 in July. The result was expected to decline moderately to 56.7. With the third consecutive decline in the index, the reading reached its lowest level since November 2020.

Meanwhile, the assessment of the economic situation advanced 7.4 points to 29.3 points in August. But that was just below economists' expectations of 30.0. Commenting on the results, ZEW President Achim Wambach said that the third consecutive drop in forecasts indicates increased risks to the German economy, such as a possible fourth wave of COVID-19 starting in the fall or a slowdown in growth in China. Wambach added that "the apparent improvement in the assessment of the economic situation that has been going on for months shows that the outlook is also weakened by the high growth that has already been achieved."

The sentiment of financial market experts regarding economic development in the Eurozone weakened for the third time in a row. The corresponding index fell 18.5 points to 42.7 points in August. In contrast, the current economic situation index rose 8.6 points to 14.6 points in August. Moreover, the survey showed that inflation expectations in the Eurozone fell by 27.4 points in parallel with the decline in economic expectations. The inflation index is currently 42.2 points.

The average number of new coronavirus infections in the United States is over 116,000 per day, including about 50,000 hospitalizations, levels not seen since the winter surge. Unlike other points in the pandemic, hospitals now have more non-COVID patients for everything from car accidents to surgeries that have been postponed during the outbreak. The United States is currently facing a severe shortage of frontline staff to the epidemic.

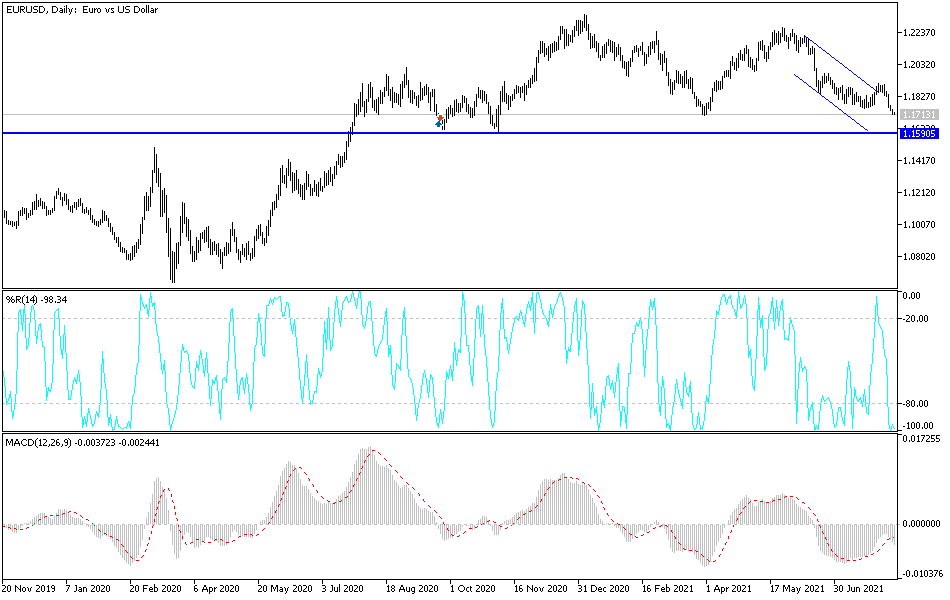

Technical analysis of the pair

On the daily chart, the recent losses of the EUR/USD are moving to strong oversold levels. Nevertheless, the bears may have the opportunity to move further downward to the support levels of 1.1665 and 1.1590 in the event that the euro does not gain momentum to stop its losses. This may happen with the return of investor confidence from the fears of COVID and the improvement of the economic performance of the Eurozone. From the mentioned levels, you can consider buying the currency pair and waiting for a bounce back.

On the upside, without moving towards the 1.2000 psychological resistance, the general direction of the pair will remain bearish. The currency pair will react strongly today to the release of US inflation figures, the Consumer Price Index and the market's reaction to the results. Less inflation may halt the gains of the US dollar.