The currency pair's gains were primarily due to the weakness of the US dollar, following the announcement of the US Federal Reserve and the announcement of lower-than-expected growth for the US economy. The euro is still facing pressures that may give up on its impact many of its gains, the most prominent of which is the expansion of the spread of the Corona Delta variable. This means the return of the closure restrictions, in addition to excluding the date for tightening the European Central Bank’s policy.

The euro's gains were halted at the end of last week's trading after data released by the European statistics agency Eurostat indicated that the outlook for the euro zone economy may be very pessimistic after a turbulent start to the current year. Data on Friday showed that the European economy grew at a quarterly pace of 2% in the three months to the end of June, faster than the 1.5% increase likely by measures of consensus among economists.

This reversed the -0.3% contraction seen during the early months of the year when large parts of the continent, as in other parts of the world, were subjected to economically devastating business shutdowns and severe restrictions on social contact.

Commenting on this, Bert Cullen, Chief Eurozone economist at ING said: "While variable delta and supply chain issues pose significant risks to the outlook, we expect the recovery to maintain this rapid pace in the third quarter." "Despite all the greening efforts, the eurozone economy continues to perform like a diesel engine: it may take some time to move forward but don't underestimate it once it gains traction," adds Colin.

Separately but at the same time, Eurostat also said that the unemployment rate for the European single currency bloc was 7.7% in June and at the end of the above-mentioned period, down from the previously upwardly revised 7.9%, and lower than the expected 7.9%. By consensus for June. In addition, the Eurozone inflation rate rose above 2% for the first time since October 2018 when 2.2% was reported for July, putting it above the identical 2% target level of the European Central Bank (ECB). After rising from 1.9% previously.

However, core inflation was much lower, having held steady at 0.7%, indicating that much of the inflation pressure implied by the above figure is caused by volatility in energy prices and changes in regulated price items such as alcohol and tobacco which are all ignored by basic scale. For his part, Dr. Ralph Solvin, an economist at Commerzbank, says: “The growth rates in each individual country vary greatly, due on the one hand to the different timing of easing Corona restrictions and on the other hand to the strength of the previous recession.”

The EUR/USD pair was previously among the first to benefit when Federal Reserve Chairman Jerome Powell indicated last week that economists, analysts, and financial markets may have been more upbeat when they expected the bank to announce in September that plans to end the 120-dollar Fed quantitative easing program would be agreed upon. Speaking at the press conference following Wednesday's decision, President Powell's comments followed a wave of dollar selling that continued into the last session of the week and may have also supported the euro against the dollar after last Friday's data.

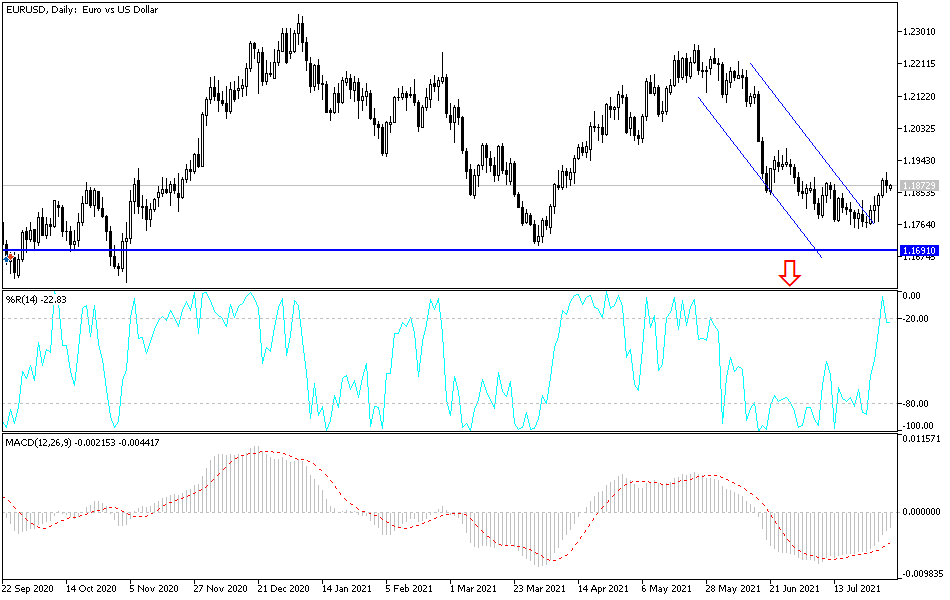

According to the technical analysis of the pair: On the daily chart, the bulls will have the strongest control over the performance of the EUR/USD pair by moving towards the 1.2000 psychological resistance, which stimulates more buying technically. This may happen if the movement returns to the resistance 1.1920. On the downside, the currency pair may abandon its current path by moving towards the 1.1770 support level. I still see that its gains may face selling to take profits quickly. The euro will be influenced today by the German retail sales and then the manufacturing purchasing managers' index for the euro-zone economies.