The EUR/USD was quick to recover after the recent turmoil in the global markets. The pair rebounded towards the 1.1750 level after its recent sharp losses, reaching its lowest level of the year when it plunged to the 1.1664 support level. Despite the rebound, the pair's losses may continue in the event that factors such as expected tightening of the Federal Reserve's policy and the spread of the delta variant continue. Nevertheless, the euro is likely to benefit from the recent disintegration of commodity currencies after being sold off earlier in the year in order to fund bets on exchange rates and assets whose exposure was expected to be widespread.

Overall, moving away from these bets or simply scaling back has seen some investors buy back the euro in a process that would explain the recent resilience of the EUR/USD, as well as the "bullish divergence" between the falling exchange rate and the now rising RSI measure of momentum on the charts, which technical analysts say may stabilize the EUR/USD pair over the coming days. Commenting on this, Paul Siana, chief technical strategist at BofA Global Research says, “This divergence calls for a sell-off rather than a breakout,” which outlined the collapse of the euro and dollar last week and the simultaneous rally in the US Dollar Index since late July.

The euro was pressured along with other currencies last week while the dollar rose against all major currencies to become the best performer in the G10 in 2021, as investors were concerned about the global economic outlook and the Fed once again indicated that a notable change in its monetary policy is likely to appear in the coming months.

Vadim Yaralov, an analyst at BofA Global Research, says, “The downside risks to the euro have increased. There are now strong continuation signals for the euro’s bearish trends against the British pound, the Canadian dollar and the New Zealand dollar, and a reversal signal for the euro’s bullish trend against the Australian dollar.”

While global markets have since stabilized and enabled the EUR/USD to rebound this week, the divergence between the monetary policy of the Federal Reserve and the European Central Bank (ECB) will come into the spotlight again in the coming days which is another reason why the pair may struggle to extend its recovery much further this week. Commenting on the EUR/USD outlook, Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank says: “The bottom at 1.1665 has not been confirmed by the daily RSI and we will allow some slight consolidation before losses to 1.1602, the low in November 2020.”

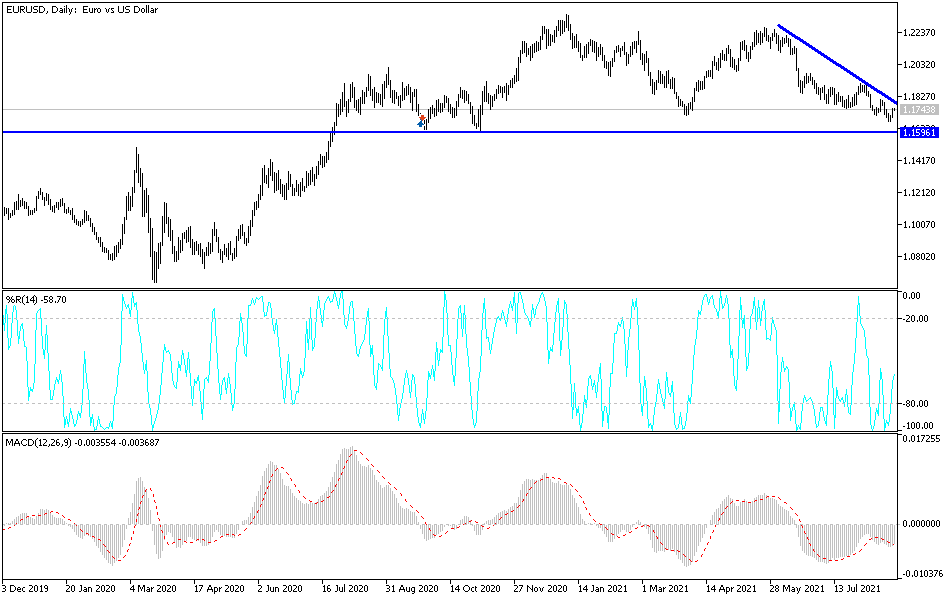

Technical analysis of the pair

Despite the recent rebound, the general trend of the EUR/USD currency pair is still bearish, and stability around and below the 1.1700 support still gives the bears enough momentum to move down again, especially if the above mentioned pressure factors are available. The closest support levels for the pair are currently 1.1675, 1.1600 and 1.1530, and from the second and third levels, I would consider buying and waiting for a rebound higher. On the upside, the psychological resistance at 1.2000 is still the most important for a return to a bullish performance, otherwise the general trend will remain bearish.

The Jackson Hole event will have the most impact on the EUR/USD by the end of trading this week.