US inflation figures came in as expected, causing the major currencies to achieve some gains against the US dollar. The EUR/USD rebounded to the 1.1754 level, starting with a correction from its lowest level of 2021, where it tested the 1.1706 support level before the US data was announced. Bureau of Labor Statistics data have provided more provisional evidence that US inflation may be at its peak, although some analysts say the risk of the EUR/USD slipping below 1.17 still stands.

US inflation has more than doubled this year and has prompted market participants and Federal Reserve officials alike to start thinking about the idea that interest rates in the world's largest economy may need to rise sooner than most imagined.

But gauges of July CPI inflation from the Bureau of Labor Statistics made another suggestion that US central bankers might have been right after all, primarily when they said the recent explosive gains in the prices everyone paid were just a "transient" phenomenon.

"Inflation has remained high, but the results have not exceeded the already high expectations," said Neil Wilson, chief market analyst at Markets.com. "Inflation is here to stay, but we don't feel the Fed getting too concerned just yet, and if anything, the slowdown in price growth is allowing the Fed to take a slower path toward tapering, so the risk is finding some bids."

These results are not unlike those reported by the Bureau of Economic Analysis of the Fed's preferred inflation metrics, PCE price indices, for June. In this regard, Dr. Christoph Bales, chief economist at Commerzbank, says: “In the United States, it is likely that the high inflation caused by Corona has exceeded its peak.” Commerzbank said in a note after the release that while inflation rates may cross their peak and could decline significantly next year - mainly due to statistical "base effects" and mitigation of other temporary factors - the data is unlikely to touch. The Federal Reserve deviated from its recently charted course of curtailing its $120 billion per month quantitative easing program.

All in all, tapering expectations have been building up in recent months and throughout the period the European Central Bank (ECB) has made clear it will likely continue its bond-buying program until at least the end of the first quarter of 2022, which is significant. Part of the reason for the euro's exchange rate against the dollar was pressure during the second quarter and so far in the third.

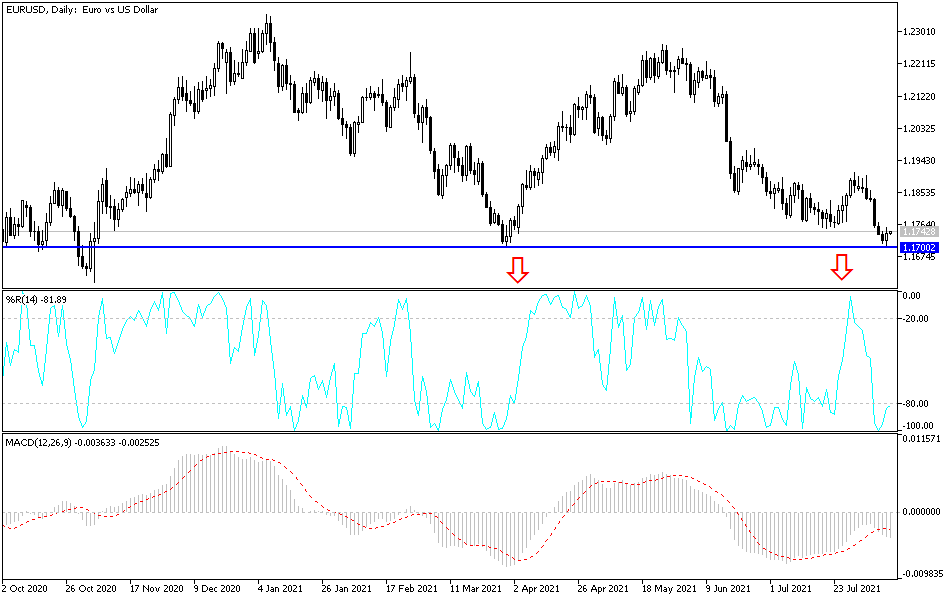

Technical analysis of the pair

The recent correction attempts are still weak, and the EUR/USD is still under downward pressure. The pair is near the 1.1700 psychological support, which symbolizes the extent to which the bears control the performance and are ready to test stronger support levels, the closest of which are 1.1655 and 1.1580. To the upside, the reversal will be strong and the pair will exit its sharp bearish channel if it moves towards the resistance level of 1.1920 and the psychological peak of 1.2000. Otherwise, the general trend of the pair will remain bearish.

For the euro, the rate of industrial production in the Eurozone will be announced. From the United States of America, the Producer Price Index, one of the tools for measuring US inflation, will be announced, along with the number of weekly jobless claims.