The bears triumphed last week as the EUR/USD fell to the 1.1664 support level, its lowest in nine months, before closing trading around 1.1700. The new COVID wave will bring negative results to the European economy sectors in particular, which will keep the eur under doownward pressure for a longer period. On the other hand, the US Federal Reserve is preparing to tighten its monetary policy and this week's important symposium in Jackson Hole will clarify the direction of the central banks.

Thousands demonstrated across France to protest the COVID-19 health card now required for access to restaurants, cafes, cultural venues, sports arenas and long-distance travel. In Paris, various groups organized four demonstrations and more than 200 protests elsewhere in French cities and towns. More than 200,000 demonstrators participated in the march last week.

The health pass is given to people who have been fully vaccinated, have recently had a negative test or evidence of a recent COVID-19 recovery. France also passed a law making vaccinations mandatory for French health workers by September 15. Despite the protests, opinion polls showed that a majority of French people support the health card. Millions have received the first dose of a vaccine since French President Emmanuel Macron announced the measure on July 12.

Since last month, France has recorded a high number of infections - about 22,000 cases every day, a number that has remained stable over the past week. More than 47 million people in France, or 70.2% of the population, have received at least one shot of the vaccine and more than 40.5 million, or 60.5%, have been fully vaccinated.

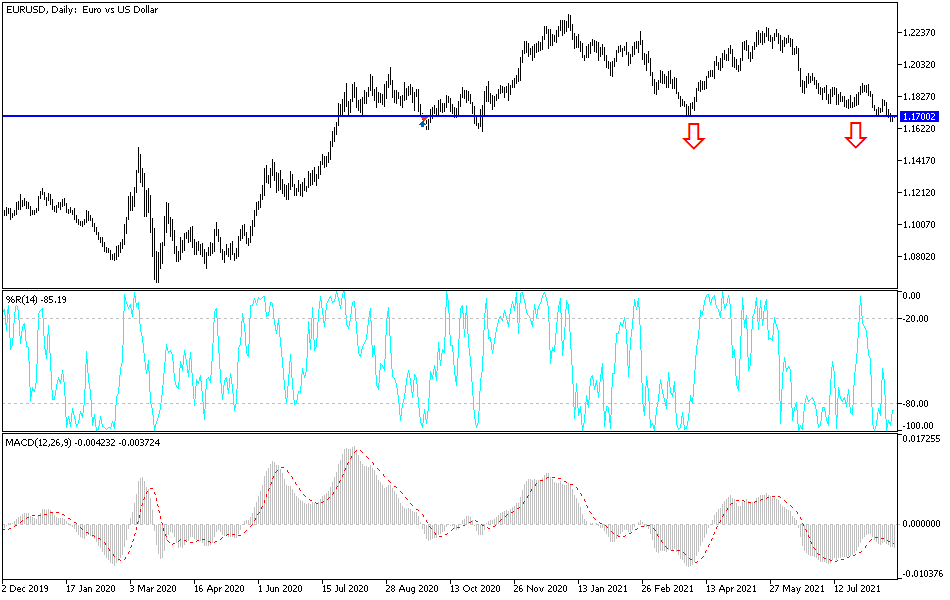

The drop in the EUR/USD below the 1.17 support represents an important milestone in the current attack on the US dollar, and we hear from analysts that a break in the trend is unlikely in the near term, based on relevant technical chart setups and influential fundamental drivers. Georgette Boyle, chief Forex strategist at ABN AMRO, says: “The EUR/USD fell below 1.17, and a move to the previous lows set between 1.16-1.1615 is possible, and a breakout below 1.17 occurred last week, meaning that dollar buyers face their weakest purchasing power since November 20, 2020. The EUR/USD is in the grip of a strong technical downtrend as the pair is on its way to reach 1.1450 before the end of this year.”

"Concern about the spread of the Delta variant, deteriorating investor sentiment and expectations of less accommodative ECB policy are the main drivers,” the analyst added about the main drivers of the EUR/USD's bearish performance. However, "less favorable central bank policy" refers to the US Federal Reserve and not the European Central Bank (ECB) which is likely to maintain its "easy" policy settings for several months now, a fundamental headwind for the single currency.

As investors see a Fed rate hike in late 2022/early 2023, the timing of such a move in the European Central Bank dates back to 2024. This difference provides a basic account of the continued underperformance of the EUR/USD.

Technical analysis of the pair

On the daily chart, the losses of the EUR/USD reached oversold levels, and I would recommend buying and waiting for a rebound higher to correct from the support levels of 1.1655, 1.1580 and 1.1500. To the upside, the 1.1800 resistance will be the first step towards a bullish trend.

The currency pair will be affected today by risk appetite and the reaction to the Manufacturing and Service PMI readings for the Eurozone economies. Then, the new US home sales figures will be released.