Bearish View

Set a sell-stop at 1.1700 and a take-profit at 1.1600.

Add a stop-loss at 1.1750.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1800 and a take-profit at 1.1900.

Add a stop-loss at 1.1740.

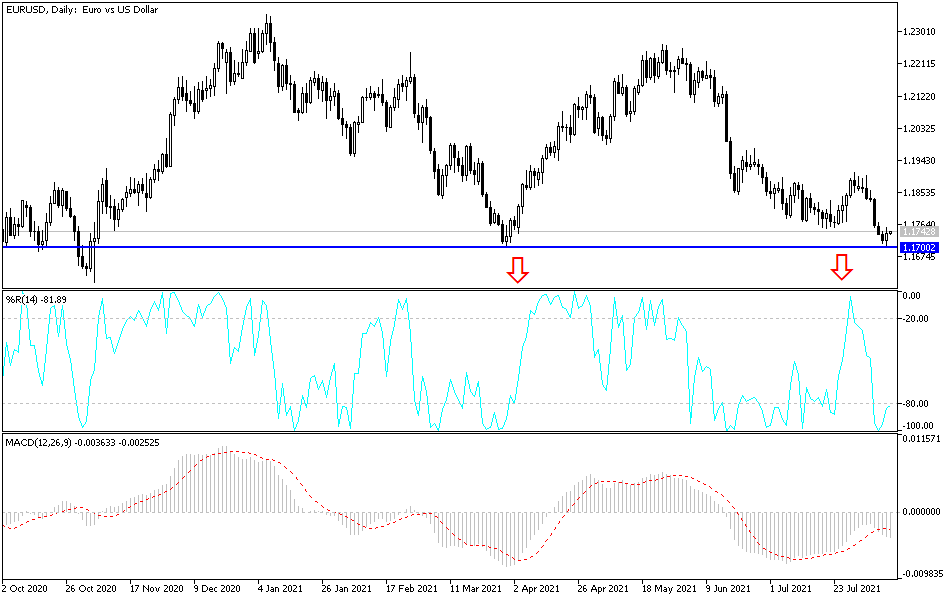

The EUR/USD price bounced back on Wednesday after the US published the July inflation numbers. After dropping to a multi-month low of 1.1706, the price rebounded to a high of 1.1750.

US Dollar Retreats After Inflation Data

The price action of the EUR/USD during the American and Asian sessions was mostly because of the relatively weaker US dollar. The US Dollar Index, which weighs the greenback against key currencies, had its first drop in a few days after the relatively weak inflation data.

The numbers revealed that the US inflation rose by 5.4% in July while core CPI retreated to 4.3%. While these numbers were higher than the Fed’s target of 2.0%, they showed that consumer prices were starting to ease as the country reopens.

Meanwhile, there are early signs that the economy is being affected by the new COVID wave. In a statement, Southwest Airlines reported higher flight cancellations and slow growth. This is notable since the aviation industry has played a significant role in the ongoing recovery. Also, the sector tends to play an important role in other sectors like hotels and restaurants.

In Europe, data from Germany showed that prices jumped in July. The headline CPI rose by 3.8% in Europe’s biggest economy as the country reopened. This was the highest figure since 2008. Still, data published during the week revealed that the country’s businesses were starting to have a negative sentiment about the recovery.

Later today, the EUR/USD will react to the latest US Producer Price Index (PPI) data. Analysts expect the data to show that the headline PPI rose by 7.3% in June as the economy bounced back. A higher PPI tends to lead to higher consumer inflation. The pair will also react to the latest US initial jobless claims numbers.

EUR/USD Forecast

The EUR/USD pair rose for the first day this week after the weak US inflation data. The pair rose from 1.1706 to 1.1750. It is still slightly below the 50-period and 25-period exponential moving averages. It has also formed what looks like an inverted cup and handle pattern. The current rebound is therefore a part of the handle section.

Therefore, while the pair will likely keep rising, there is a likelihood that it will resume the downward trend in the next few days.