Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken before 5pm London time today only.

Short Trade Ideas

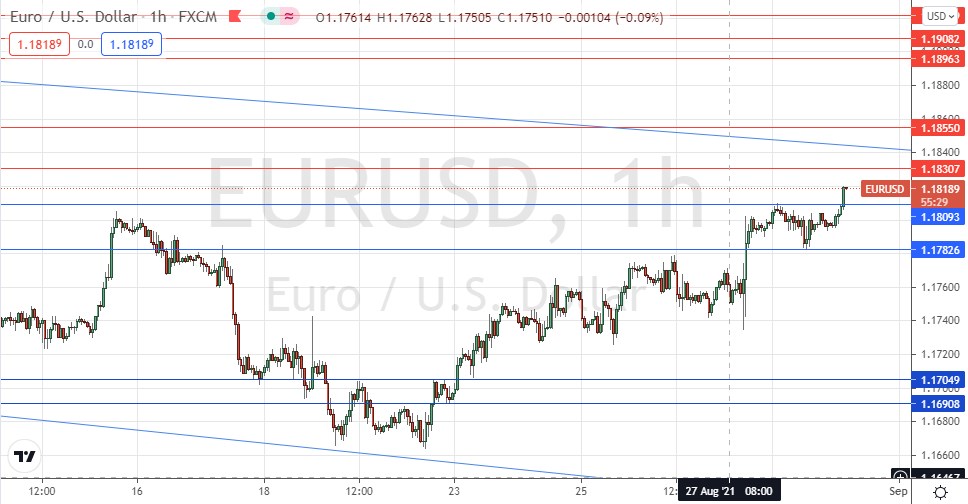

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1831, 1.1855, or 1.1896.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1809, 1.1783, or 1.1761.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that if the new higher pivotal flipped support level at 1.1761 held up, we were likely to see continued upwards movement to 1.1800 and maybe beyond.

I also thought that the round number at 1.1800 may prove to be resistant.

The level at 1.1761 did not hold but fortunately did not give a bounce justifying entry either, so my approach was at least enough to stay out of trouble. I was correct on the day, but over the weekly outlook the price did rise to 1.1800 and beyond after recovering.

The technical picture is now somewhat more bullish as the price has continued its relatively steady medium-term bullish trend, clearing the former resistance at 1.1800. The US dollar has continued to be sold off this week so the price advances here.

We are now approaching a long-term bearish trend line which is shown in the price chart below sitting at about 1.1840. This may prove to be resistant if reached.

I will be happy to enter a long trade today from a bullish bounce at either 1.1809 or 1.1783, with the latter level looking especially likely to be good support for at least a long scalp.

Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time. There is nothing of high importance scheduled today regarding the euro.