Bullish View

Set a buy-stop at 1.1900 and a take-profit at 1.200.

Add a stop-loss at 1.1850.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1850 and a take-profit at 1.1750.

Add a stop-loss at 1.1950.

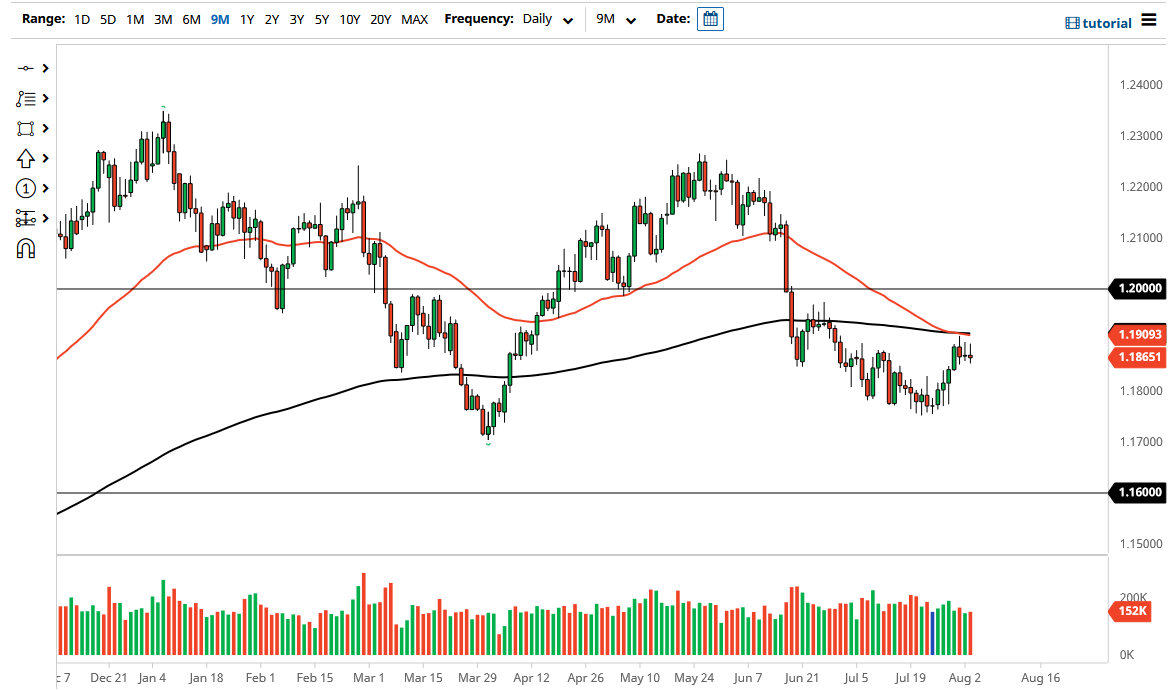

The EUR/USD price has been struggling to find direction this week. The pair was trading at 1.1875 on Wednesday morning, where it has been in the past few days. This price was about 1% above the lowest level last week.

Eurozone PMI and Retail Sales

The top catalysts for the EUR/USD will be the latest Eurozone PMIs and retail sales numbers that will come out later today. Data by Eurostat is expected to show that the Services PMIs remained above 60 in July even as countries faced rising COVID cases.

The Composite PMI for the region is also expected to come in at 60.6 as countries continued seeing robust recovery. For example, the German Composite PMI is expected to rise to 62.5 while the French PMI is expected to increase to 57. These PMIs are important because they show the overall performance of the economy.

Eurostat will also publish the latest Eurozone retail sales numbers in the morning session. Economists polled by Reuters expect that the sales increased by 1.7% in June after rising by 4.6% in the previous month. On a year-on-year basis, the sales are expected to rise by 4.5% after rising by 9.0% in the previous month.

Meanwhile, in the US, Markit and the Institute of Supply Management (ISM) will publish the latest Services PMI data. The ISM figure is expected to rise from 60.1 to 60.5, which is a sign that the economy did well in July. However, with states like New York introducing vaccine mandates, there is a possibility that this recovery will start slowing down.

The EUR/USD will also react to the latest US employment numbers. On Wednesday, ADP will release the closely-watched private payrolls data. This will be followed by the initial jobless claims that will come out on Thursday and non-farm payrolls scheduled for Friday.

EUR/USD Price Action

The 4H chart shows that the EUR/USD pair made a bullish breakout above the rising wedge pattern last week. The pair then rose to a high of 1.1908, which was the highest it has been since June 29. In the past few days, it has formed what looks like a bullish pennant pattern. It is also slightly above the 25-day 50-day moving averages. Therefore, the pair will likely break out higher as investors target the next key resistance at 1.1950.