The euro rallied a bit during the trading session on Wednesday as the world awaited the Consumer Price Index figures from the United States. However, we have seen that come and go and, as the market got the expected news, the US dollar lost a bit of its luster. The interest rates fell just a bit, but at this point in time the market had been so oversold that a little bit of a bounce did make sense.

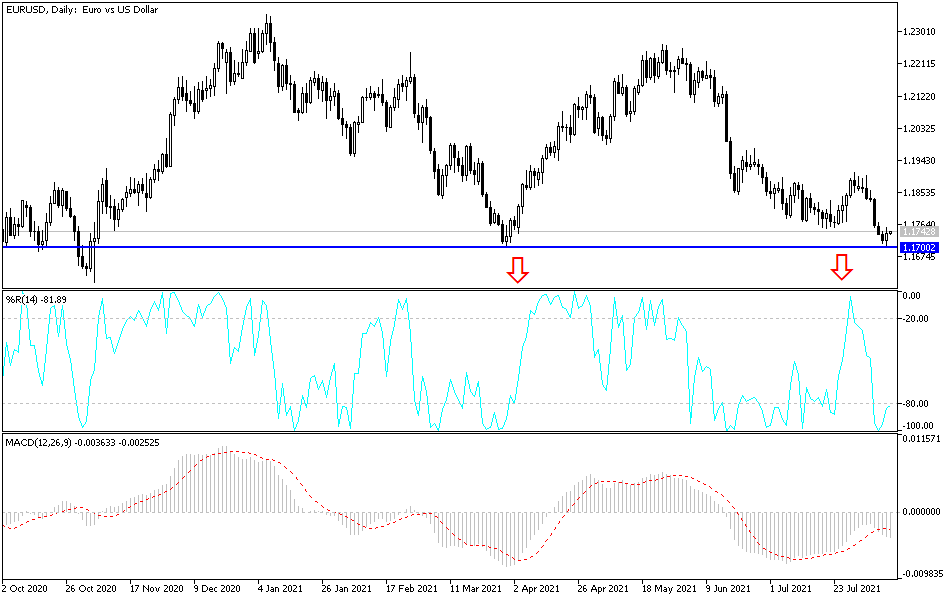

The 1.17 level is an area that has offered support over the last couple of days, as it is a large, round, psychologically significant figure. Bounces at this point will probably continue to be sold into, especially after the recent pressure that we have seen to the downside. We also have recently had a “death cross”, which is a longer-term selling signal. The market would need to break above the 50-day EMA at the very least for me to get excited about buying, and at this point it is likely that the market will find exhaustion to sell into, to continue to push the euro lower.

If we do break down, the 1.16 level underneath will be support, extending all the way down to the 1.15 level which is a support “zone.” That is an area that has been important on longer-term charts and should continue to be so. I think we will probably get a little bit of noise over the next couple of days, and I would also anticipate that the 1.18 level above is going to offer a little bit of psychology and selling pressure. At the first signs of exhaustion, I anticipate the sellers will jump back into pick up “cheap dollars.”

The size of the candlestick does not inspire a lot of confidence, so even though we have had a little peek of bullish momentum, the reality is that the recovery was not very strong, and I think it will be very tenuous at best to the upside. The higher we go, the more likely I am to short this market, and with reasonable size. If we break down below the lows of the last couple of candlesticks, then the market is likely to go looking towards the 1.17 level and then eventually the 1.16 level as mentioned previously.