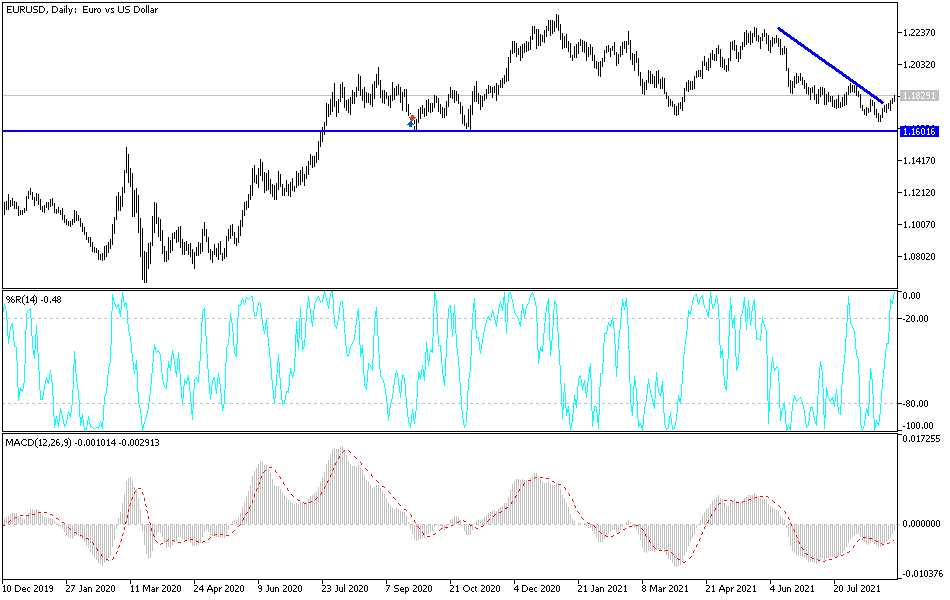

The euro initially tried to rally on Monday, but gave up gains just above the 1.18 level, suggesting that perhaps we are still “stuck” in the same pattern. The 50-day EMA above offered resistance is also a bearish picture, so at this point I think we are more than likely going to see a bit of a pullback. However, if we were to break above the 50-day EMA, then we could see the market go looking towards the 200-day EMA above.

The recent “death cross” does suggest that we will go lower, but I think that this is a market that is going to continue to chop around between now and Non-Farm Payroll Friday. That will have major ramifications as to what happens with the greenback, which is a major driver of this pair. I think over the next couple of days we are simply going to be looking around this area to figure out whether or not we can get any type of momentum. If we break down below the candlestick for the Monday session, then I think we will go looking towards the 1.17 level, maybe even the 1.16 level. The 1.16 level is a major support level on the longer-term charts, and I think we will have to pay close attention to whether or not we can break down through there.

If we were to break out to the upside, this would obviously be a huge “anti-US dollar” type of move, and you would probably see the greenback losing value against almost everything. The shape of the candlestick is a bit of a shooting star, so that does suggest some negativity, but I think the moves are going to be very small and back and forth. Because of this, keep your position size small, because this market that will chop up your trading account if you are not careful. The last week of August is typically very quiet, as it is a major holiday week, so there may be a lot of problems when it comes to liquidity as well. Therefore, I do not think that the market is ready to go anywhere quite yet, but as we roll into September, the later we get into the month the more likely we are to see volume and therefore bigger moves.