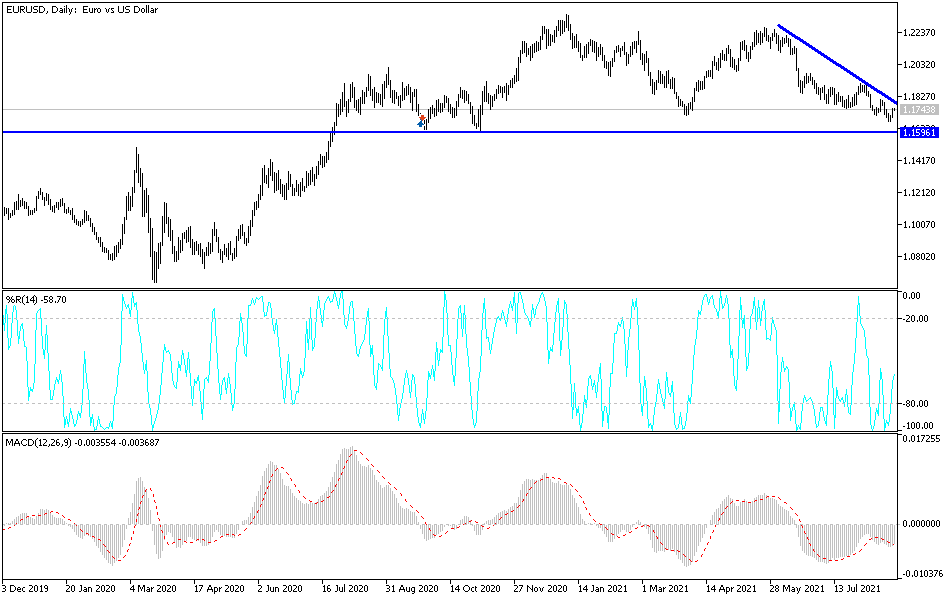

The euro rallied significantly on Monday to kick off the week on the right foot. We managed to test the inverted hammer highs from the trading session on Wednesday, dancing around the 1.1750 level. That is an area that should be resistance, and you can also see that we have a bit of a falling wedge, which is also a potential bullish sign. Ultimately, this is a market that is going to be waiting on statements coming out of the Jackson Hole Symposium, which is going on this week.

The market could perhaps be moving based upon the idea of short covering, or perhaps traders trying to get ahead of the statement as they believe that the Federal Reserve will come to the rescue and keep the liquidity measures extraordinarily loose. There have been several statements by voting Federal Reserve governors that suggests that tapering could be coming between now and the end of the year, which could drive up the value of the US dollar again. At this point, I think everybody is waiting for the statement in order to get an idea as to where we go next.

The longer-term support is near the 1.16 level, and we have not gotten there quite yet, so I think it is likely that we will continue to see the market try to get there one way or another. But if we do get a complete change in attitude from Jerome which suggests that there is no way they are going to taper, then that obviously would send the euro much higher. Or, put another way: the US dollar will lose value against almost everything.

To the upside, the 50-day EMA is sloping lower, and it could offer the next resistance barrier if we break above the downtrend line, but I think the only thing that you can count on is that there is going to be a lot of noisy and choppy behavior, so you need to keep your position size somewhat reasonable as it can keep you out of trouble. I suspect by the end of the week we might have a bit more clarity as to where we are going longer term, but right now expect noise more than anything else.