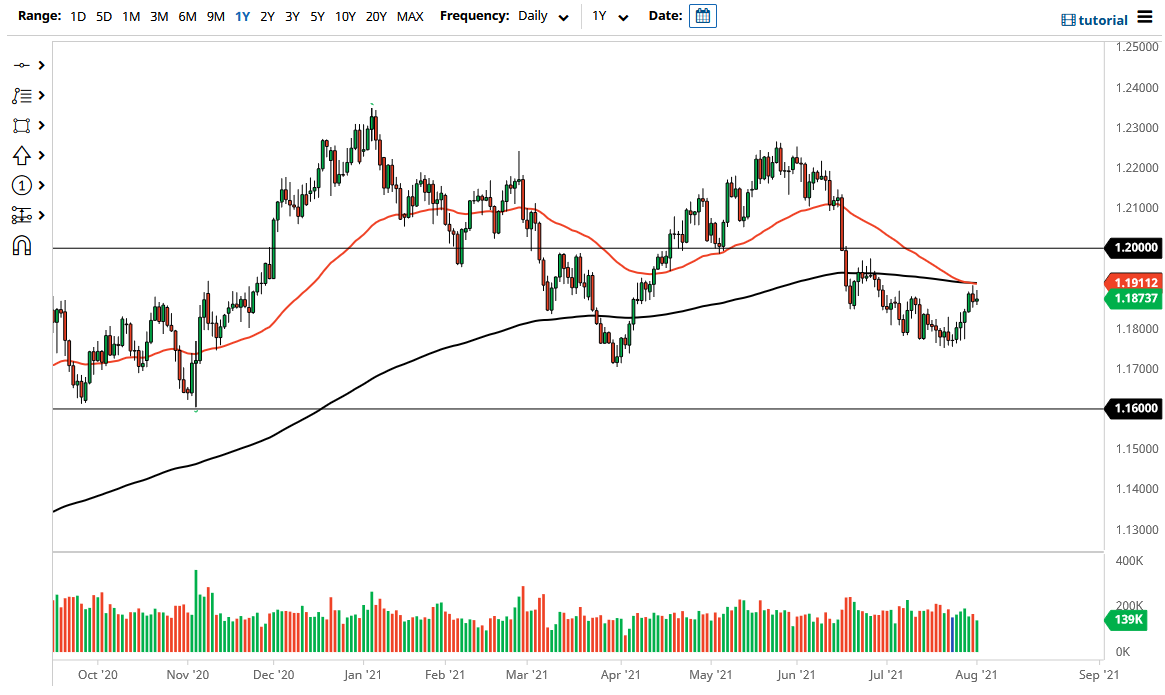

The euro initially tried to rally during the trading session again on Monday but turned around to show signs of weakness as we rolled over in the same general vicinity. The 1.19 level above has offered quite a bit of resistance, just as the 50-day EMA and the 200-day EMA are both sitting in that same general vicinity and threatening to form the “death cross”, which is a very negative turn of events from a longer-term standpoint.

Looking at this chart, I think we are ready to continue going lower, as the market has seen a lot of negativity as of late, but the short-term pop is more or less going to be a reaction to the fact that the market got a very dovish Federal Reserve statement. With that being the case, the market continues to hear a lot of questions out there regarding where we go next, due to the fact that the euro got sold off so drastically.

If you look at the bond markets, German bonds are negative yielding, while the United States offers some type of return if nothing else. That helps the US dollar over the euro, which is something to pay close attention to. Furthermore, we have the jobs number coming out later this week, which always has a major influence on what happens with the greenback going forward. This is a market that I think will continue to see more downward pressure than up, especially as the market goes looking towards the 1.1750 level underneath. That is where we bounced from, and that means that there will probably be a significant amount of support there. However, if we break down below there, it is likely that the market will go looking towards the 1.16 level underneath, which has been massive support multiple times in the past.

On the other hand, if we were to turn around and break above the 200-day EMA, then it is likely that the market could go looking towards the 1.20 handle above. The 1.20 handle is a large, round, psychologically significant figure, and one that I think will have the market paying close attention to it. The 1.16 level offers support that extends all the way down to the 1.15 handle, as it is a massive “zone of support” in general.