The euro fell yet again during the trading session on Monday as we continue to see interest rates in the United States pick up. That is a strong reason for a currency to pick up, as interest rate differentials will continue to drive currencies over the longer term. After all, Germany is offering negative yields at the same time, so that should continue to drive the value of the greenback higher not only against the euro, but also multiple other currencies as well.

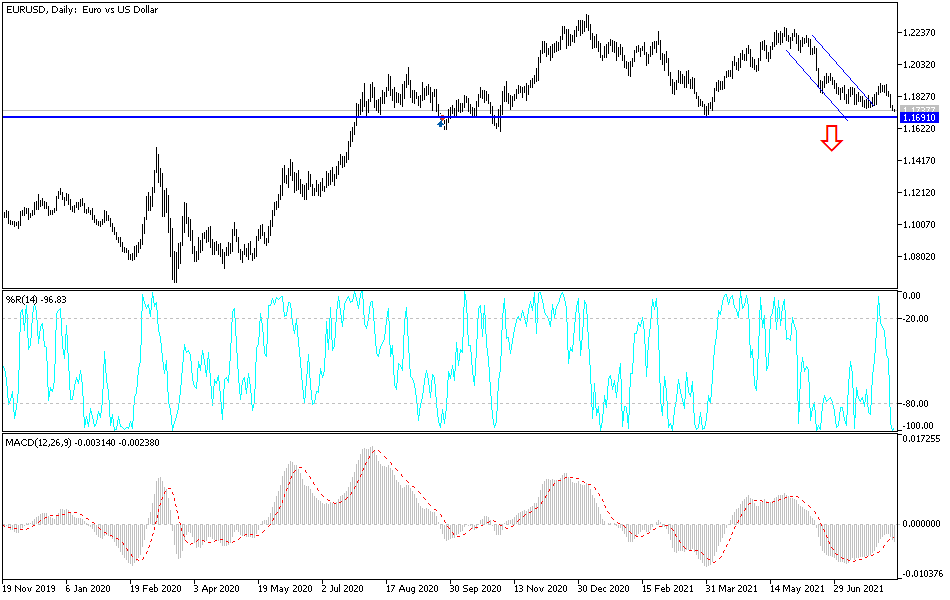

Now that we are breaking through the 1.1750 level, the market is likely to go looking towards 1.17 level, and then the 1.16 level underneath. That is a massive support level that we will continue to pay close attention to, as it is such a historically important level. In fact, I believe that the support level at the 1.16 level extends all the way down to the 1.15 level, which is a psychologically and structurally important figure as well.

In general, this will be all about the interest rates in the United States, and what is going on there. I think that given enough time we will have to pay close attention to what is going on with the the 10-year note, which often has a lot of influence on what happens in the Forex markets. The European Central Bank has suggested that perhaps they could taper in the future, but the Federal Reserve is much farther ahead in the process than the Europeans are, and it makes sense that we would continue to see the greenback outperform.

As far as buying is concerned, I would have to see some type of major shift in the overall attitude of the markets. CPI this week might be the first opportunity to change the attitude, and I do not anticipate that the CPI numbers coming out of the United States are going to be low enough to make people think that the entire situation should be reversed. Keep in mind that this pair does tend to be very choppy and sluggish, but given enough time we should get some type of confirmation that could get this market moving again. This market looks very poor, and I do think it is only a matter of time before we drop.