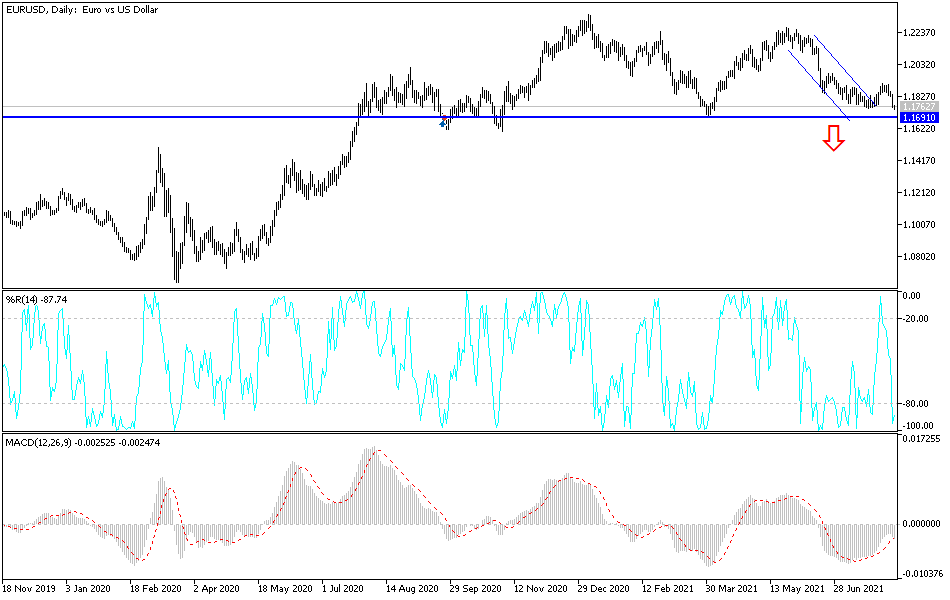

The euro got hammered during the trading session on Friday as interest rates in the United States rallied quite significantly. The market has been drifting lower for a while, and as a result, the market was already “leaning in that direction.” The size of the candlestick is rather interesting, as we have seen a lot of selling pressure through the day and then closed at the bottom of a larger range. The 1.1750 level is an area that will attract a certain amount of attention considering how we have bounced from there and it has offered support.

The 50-day EMA continues to offer resistance above, and it is likely that we will see the market participants look at that as an area worth paying close attention to. The market recently just did the “death cross”, which has longer-term traders looking at it cautiously and, given enough time, we will probably see an attempt to break down through this support barrier. If we do, then it is likely that the market will go looking towards the 1.16 level underneath, which should be significant support that extends down to the 1.15 handle.

On the other hand, if we were to take out the Friday candlestick, it would be very bullish and could have this market looking towards the 50-day EMA, but I think that would happen quite easily. If we were to break above there, then the 1.20 handle would be the next target from what I can see. After the jobs report, interest rates had spiked, causing the US dollar to attract a lot of inflows. At this point, I think the interest rate differential between the United States and Germany is going to overcome the market and send the pair much lower.

There is also the “risk on/risk off” attitude of the market that is worth paying attention to, because this is a pair that will follow right along with that. The US dollar is considered to be the “ultimate safety currency”, so that comes into the picture as well. Expect volatility, but I will more than likely be shorting this market on short-term rallies that show signs of exhaustion going forward. I do not have any interest in buying until we take out this candlestick from Friday, and even then, I would have to be very cautious.