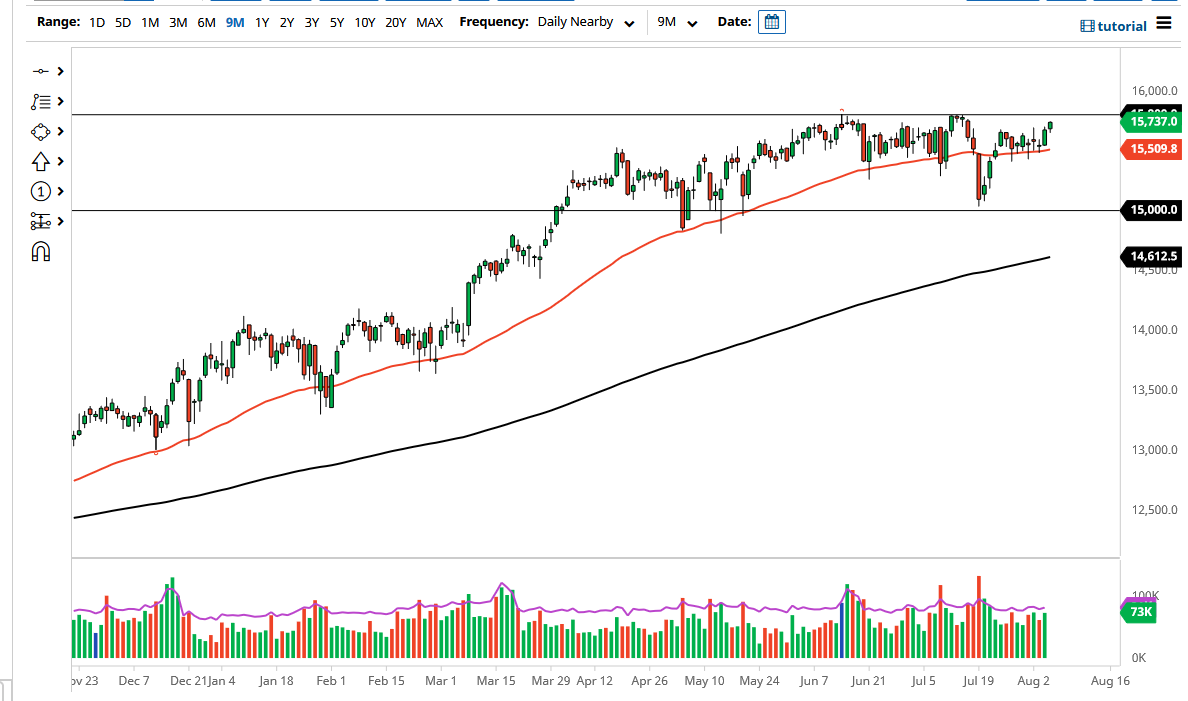

Just above, we have the 15,800 level offering resistance, as we have seen multiple times over the last several months. Because of this, I think it is only a matter of time before we do get the breakout because we have seen such a push to the upside from the 50 day EMA.

Recently, we have seen Germany lead the way as per usual, which is not a huge surprise considering just how important Germany is when it comes to the European Union. After all, Germany is one of the biggest drivers of what happens in the EU, so this is one of the most important indices to watch on the planet. If we break out above the highs here, then it is very likely that the rest of Europe follows right along. In fact, the French index has already made a fresh all-time high, and I suspect it is only a matter of time before Germany does the same.

The DAX is full of major German exporters, so therefore this is a bit of a play on the overall world economy, as a lot of the major industrial components that are needed for the reopening trade will be coming from here. With that being the case, I think we continue to see buyers on dips, as long as we can stay above the 50 day EMA. With that in mind, markets might be a little bit quiet during the day on Friday as we have the jobs number coming out the United States.

That being said, the market was to turn around a break down below the 15,500 level, we may have to revisit the 15,000 level underneath which is massive support. We do have the 200 day EMA reaching towards the 15,000 level as well, so I think eventually it will end up being the “floor in the market.” At this point, I do not see any reason to short this market, and I think that short-term traders will continue to look it dips as an opportunity to pick up value. On a daily close above the 15,800 level, I think it allows the market to kick off a big move to the upside again.