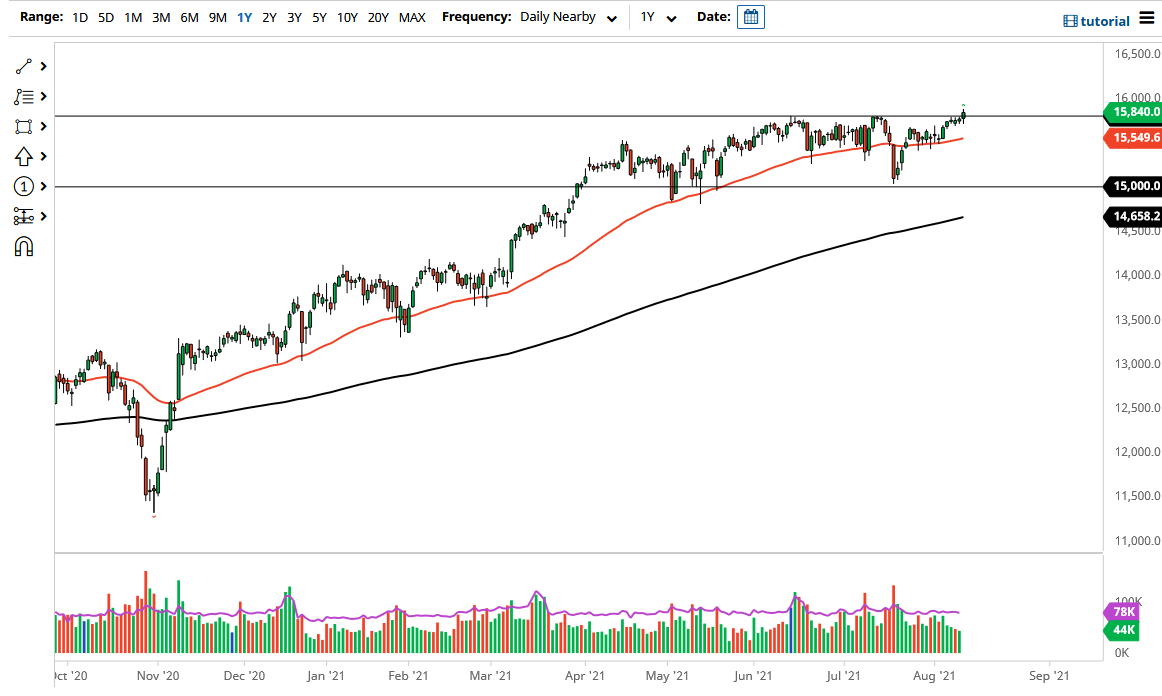

The DAX Index pulled back just a bit on Wednesday but then turned around to break above the 15,800 level. The 15,800 level was a previous resistance barrier, and now that we are above it, the most likely target will be 16,000 which is a large, round, psychologically significant figure. That being said, if we break above the top of the candlestick for the trading session on Wednesday, then it is likely that we will make that move.

To the downside, the market breaking down below the bottom of the candlestick for Wednesday signals that we could go looking towards the 50-day EMA underneath which is sitting right at the 15,550 level. That indicator is one that the market does pay quite a bit of attention to, so I think it would make a nice target to the downside. I would need to see a daily close below the candlestick in order to start shorting though, because stock markets continue to find one reason or another to go higher.

We have been in a long-term uptrend previously, and now that we are breaking out of this consolidation area, it is very likely that we will continue to go much higher. Ultimately, I think the 16,000 level would not only be the initial target, but longer term it is likely that we go looking towards the 16,500 level based upon the measured move of the previous consolidation area. The 200-day EMA is sitting near the 40,650 level and reaching towards the 15,000 level which is a large, round, psychologically significant figure that I now look at as the “floor in the longer-term uptrend.”

The candlestick is a good sign, and I think that if we continue to see traders looking towards pullbacks as value, then we will continue to lift. Furthermore, keep in mind that the German index does tend to be highly sensitive to the global growth situation, so pay attention to all of that as well, as so many of the biggest movers and the DAX are large industrial exporters. If we can continue to see the euro look a bit soft, that might also help the idea of exports out of Germany picking up, and as a result, those companies should continue to see solid sales.