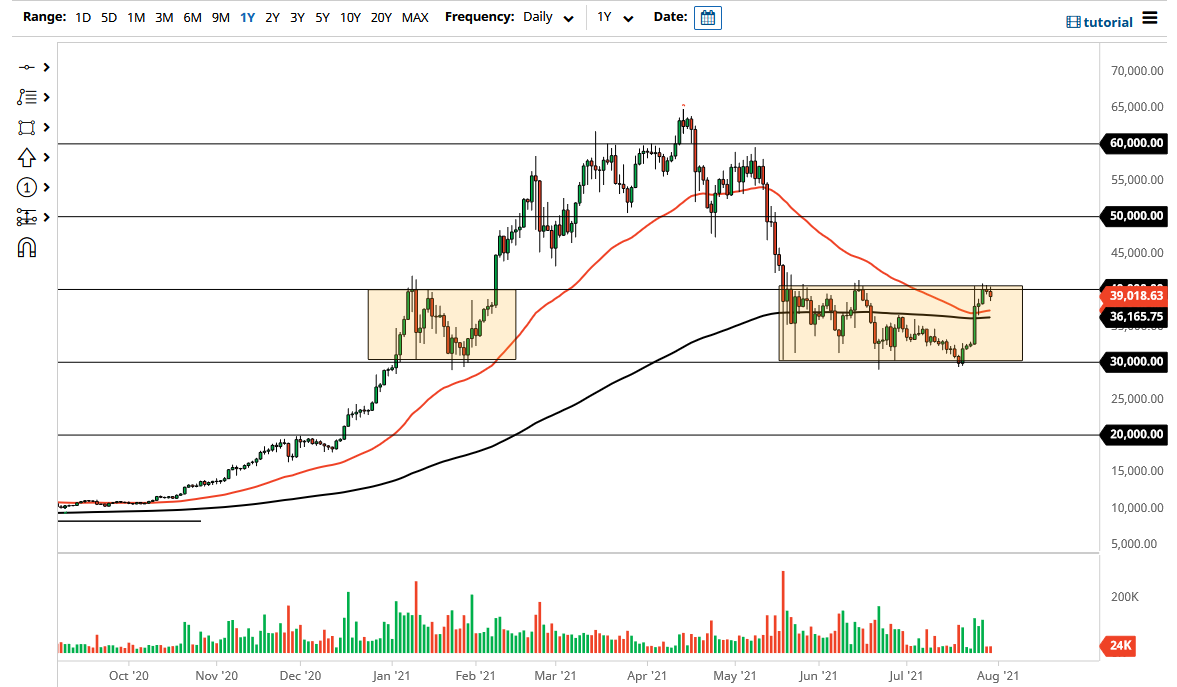

The Bitcoin markets fell a bit during the trading session on Friday, partially helped by the Deribit $21 billion worth of options expiring. Nonetheless, the reality is that the $40,000 level has been very difficult to overcome, so it not be a huge surprise to see that we have pulled back from there.

When you look at the overall action as of late, we have been bouncing around between the $30,000 level on the bottom and the $40,000 level on the top at the $10,000 range, so if we were to break out and finally take off to the upside, it opens up the possibility of a move to the $50,000 level. That is an area that will attract a lot of headline noise, as well as selling pressure due to the fact that it was previous support. Because of this, I think it is only a matter of time before the sellers would come back in and push at that point.

To the downside, we could very well drop right back to the middle of the overall consolidation region near $36,000 and sit sideways for a while. It is worth noting that after that nonsense involving Amazon, the market has not been level to break any higher. If you think about it, it was somewhat ridiculous anyway, thinking that people would be spending Bitcoin at Amazon, and knowing full well that it could be worth twice as much six months from now than it is currently. Beyond that, it is hard to imagine that Amazon would want to take on too much Bitcoin, because it could drop 30%. You can see the problem here.

With all that in the back of your mind, it should not be a huge surprise to see that we have drifted a little bit lower, but that does not necessarily mean that we need to break down drastically. I think in general we are looking for the next catalyst to take off and break out of this rectangle that we have been in. If we were to turn around and break down below the $30,000 level after this most recent surge, I think it would be an extraordinarily negative sign and could send this market much lower. At that point, I think $20,000 will probably be violated based upon the sheer exasperation it would cause.