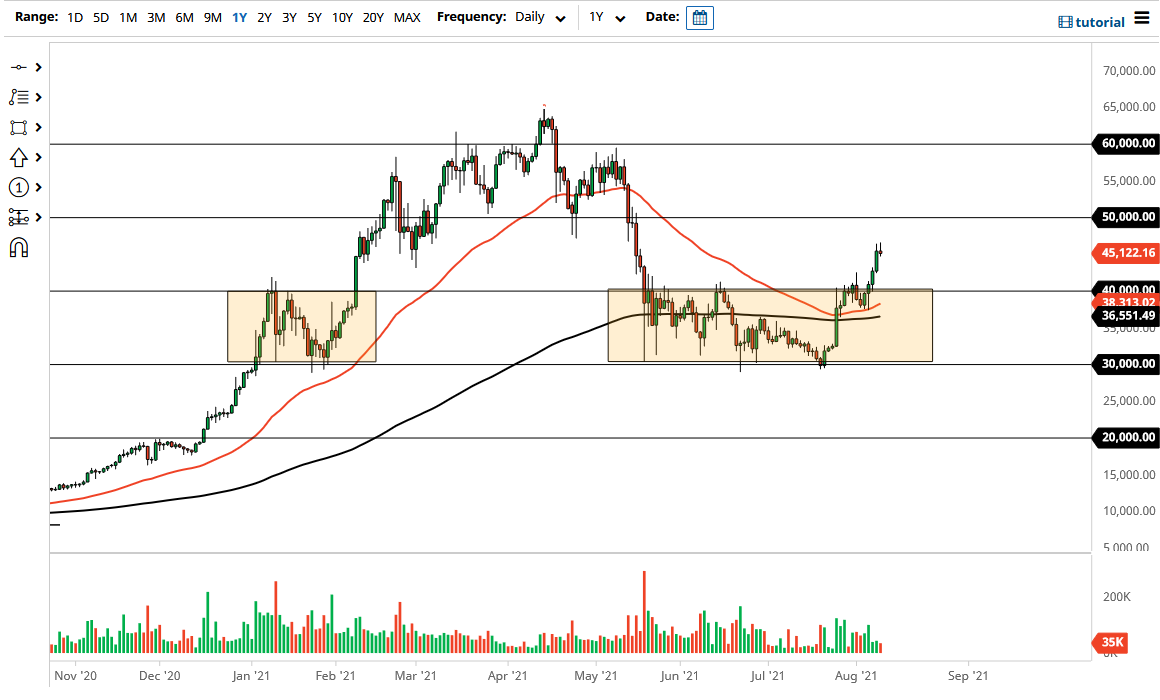

The Bitcoin market rallied again during the trading session on Tuesday but gave back early gains to form a bit of a shooting star. At this point, the Bitcoin market has gotten a bit overextended, especially as we continue to see Congress debate whether or not there are going to be specific IRS loopholes or not. Ultimately, the market is simply just ahead of itself, so I think it is only a matter of time before we have to pull back in order to find the necessary momentum.

As we broke out of the $40,000 level, it was a relatively strong sign, as it had previously been significant resistance. Because of this, I think it will probably be support if we pull back towards it, and I do anticipate that there would be a lot of buying interest in that general vicinity. Furthermore, we also have the 50-day EMA trying to turn and reach towards that area, so I think it all ties together quite nicely from a technical analysis standpoint that buyers would be interested in that area.

Keep in mind that the previous consolidation area between $30,000 and $40,000 extrapolates for a move to the $50,000 level, so I think we will eventually try to reach that general vicinity. The $50,000 level will obviously be significant resistance from a structural standpoint, but also from the fact that it previously has been support. Because of this, the market is ripe for a short-term pullback, in which those who have missed out from the move higher could get involved.

If we were to break down below the $40,000 level and the 50-day EMA, then it is likely that the market could go much lower. At that point, the $30,000 level could be targeted. That being said, I do not expect to see Bitcoin drop $15,000 to reach that area, but all things are possible that it comes to Bitcoin. Pay attention to the US dollar as well, although recently we have not seen the Bitcoin market move in a negative correlation. The inflation expectations have come into the picture as well, so if you see a sudden spike in interest rate yields in America, then it is possible that the Bitcoin market would be where money goes to fight the depreciation of wealth.