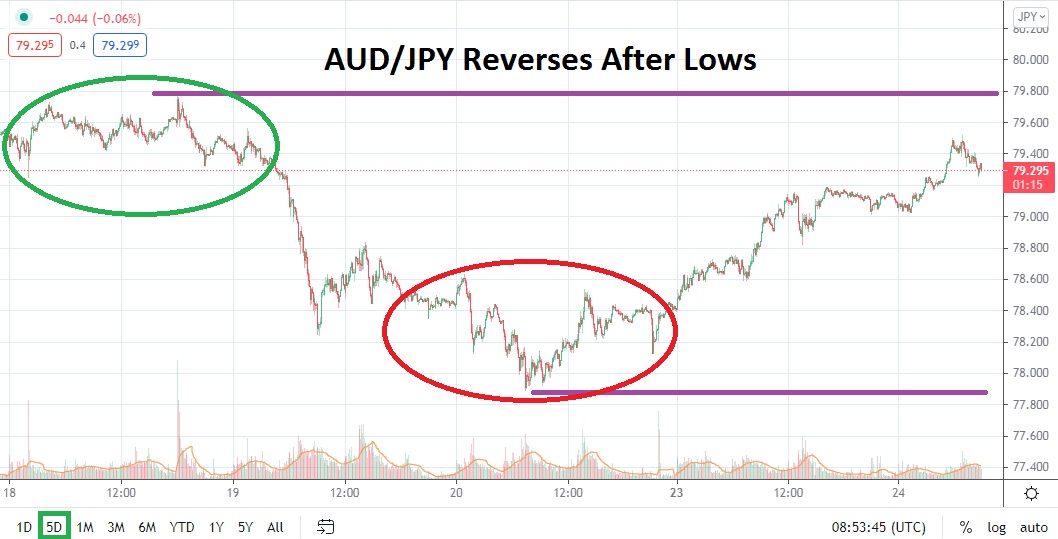

The AUD/JPY achieved a high of around 79.500 earlier today, but the Forex pair was not able to sustain this short-term high and has since stumbled slightly. The inability of the AUD/JPY to test the 79.550 mark and prove that it can maintain its value near those heights may have lessened speculative bullish perceptions, which were hoping to perhaps see last week’s price range of 79.500 to 79.750 reassert. The short-term reversal higher seen the past few days may now be challenged.

The AUD/JPY has seen a steady decline since the middle of May, but after breaking beneath the 80.800 price lower on the 15th of August momentum has quickened. The move lower has certainly been spurred on by safe haven trading implications as the AUD/JPY has been sold due to concerns regarding another coronavirus outbreak in Australia, at least this is a surface story. It must be remembered the AUD/JPY has actually trended lower in a steady fashion over the mid-term too.

Lows near the 77.900 price vicinity were seen on the 20th of August and this value remains a distant sight for the time being, but it also may serve as a warning sign. Bullish speculators may feel that the AUD/JPY has been oversold and that recent nervous sentiment within the Forex pair caused the ‘rock bottom’ price displayed late last week, thus helping spur on solid buying the past few days. However, the inability of the AUD/JPY to crack through short-term resistance may cause nervousness among speculators who are trying to decide on direction today and tomorrow.

If the AUD/JPY can climb within the 79.450 to 79.500 resistance junctures and prove it has the capability of not suffering a strong reversal, perhaps traders with bullish sentiment may want to attempt long positions again which aim for slightly higher marks. However, if the AUD/JPY begins to see an erosion in value and the 79.250 level begins to be challenged again, this may be an indication that lower depths will be explored and the recent buying momentum has run out of power.

The trend in the AUD/JPY continues to look bearish, and until a serious amount of upwards momentum is generated, it may prove to be worthwhile to wager on lower values to come. Selling the AUD/JPY on slight reversals higher may remain an attractive speculative position for traders who believe lower values and will continue to be demonstrated.

AUD/JPY Short-Term Outlook:

Current Resistance: 79.550

Current Support: 79.190

High Target: 79.800

Low Target: 78.870