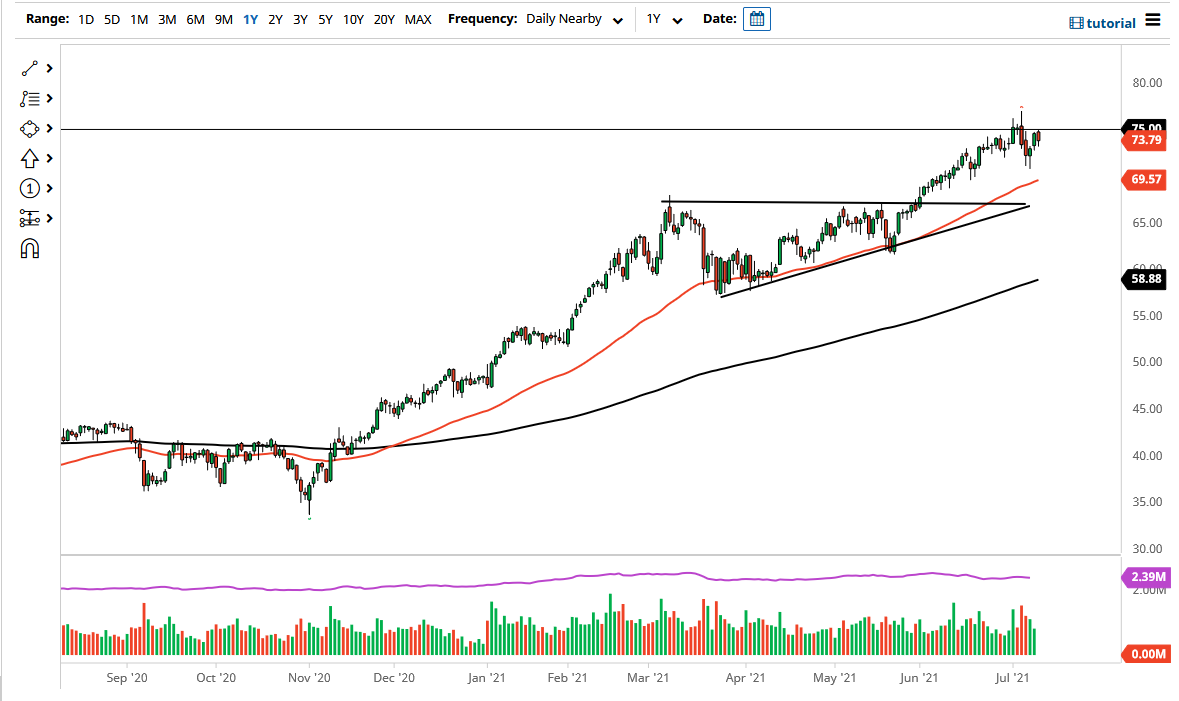

The West Texas Intermediate Crude Oil market fell a bit during the trading session on Monday as the $75 level has offered a bit of resistance. The $75 level is a psychologically important figure, but at the end of the day it is an area that we have been through a couple of times. With that in mind, it is not as if it is going to be impossible to get through there.

However, it is worth noting that there are still a lot of concerns about any type of production agreement with OPEC+, as we still have not gotten a definitive answer as to how things will turn out. The United Arab Emirates has been a thorn in the side of the cartel, as they wish to open the taps and send plenty of crude oil into the market. Sooner or later, there will probably be some type of agreement that the cartel comes to, but there are bigger fish to fry when it comes to this situation. After all, there are serious concerns about global demand suddenly, and it is worth noting that the US dollar is making a bit of a stand as well. The crude oil market is priced in US dollars, so if the greenback rises, that often works against the value of this market as well.

To the upside, if we can break above the highs of last week, then it opens up the possibility of moving towards the $80 level. The $80 level is a large, round, psychologically significant figure, and one that I think would attract a lot of headline noise. Until recently, there has been a lot of “crude oil is going to $100 a barrel” talk, but that quite often suggests that the market is getting ahead of itself. That is not to say that I am calling for a top in the market, just that perhaps the market has gotten ahead of itself.

To the downside, if we were to break down a bit, we could go looking towards the $70 level, which is a large, round, psychologically significant figure, and has the 50-day EMA running towards it, so that comes into the picture as well. This is a market that has been in an uptrend for quite some time, so I certainly am not ready to start shorting it, but I think we have a lot of choppy behavior in the short term.